The State of Football Social Media 2022: The Results

This year's State of Football Social Media survey was the biggest yet. See how football teams around the world are using their digital marketing channels.

This year's State of Football Social Media survey has been completed. This time round 126 people from all over the world took the time to answer a few questions on how their clubs use social media tools.

First of all, thanks to every single person who took the time to fill this in. It's always open at one of the busiest times of the season for most teams, so thank you.

You can read last year's results here. I'll be referring back to them when it's relevant. At the end of this article is a Google Sheet containing the data used to compile this report.

The respondents

This year's respondents came from 13 different countries. England was by far the most represented country, with around three quarters of people being based there. Scotland followed with 18, followed by countries such as the USA, Wales, Russia, Denmark, Italy, and Egypt.

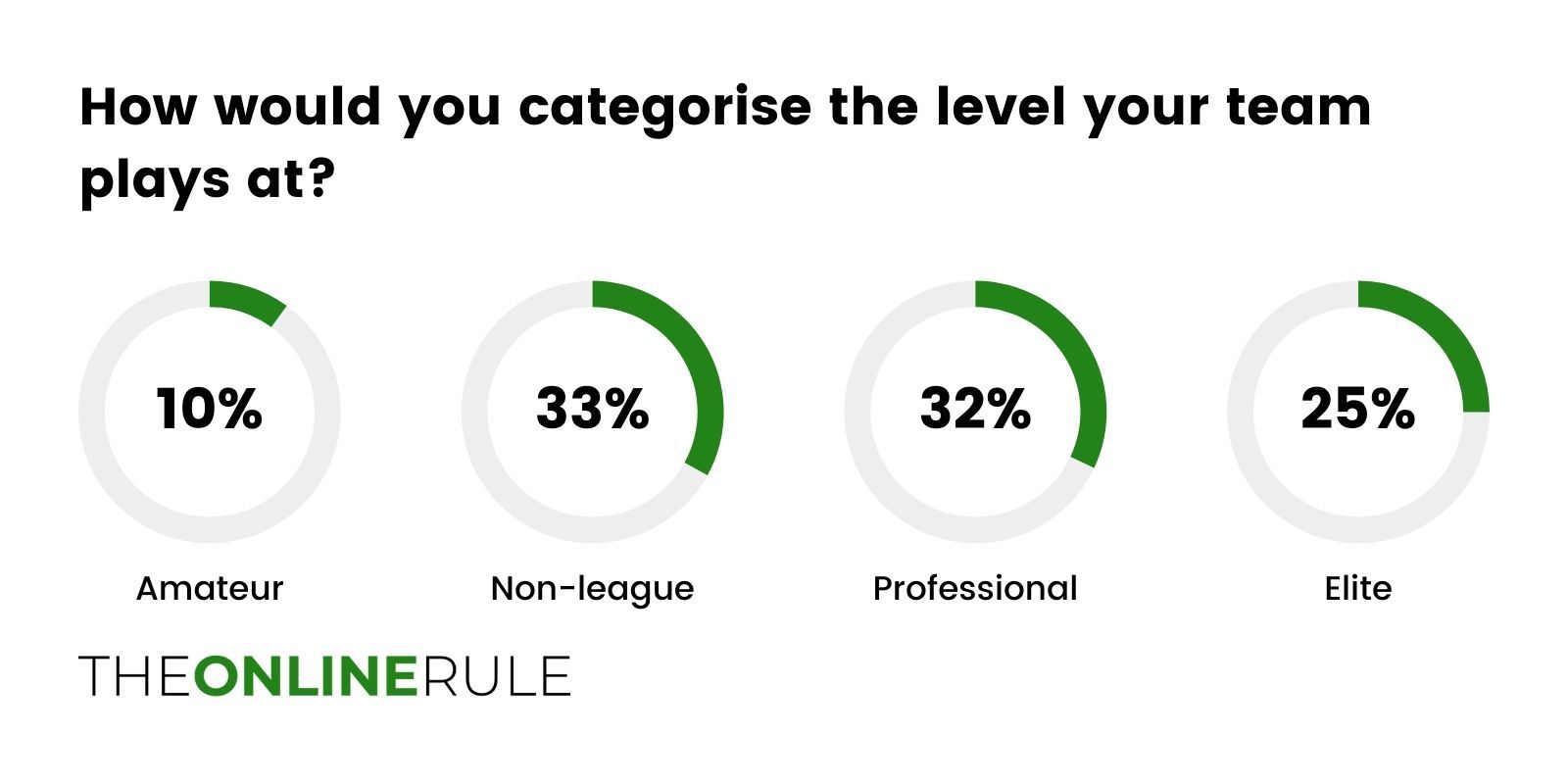

They predominantly work in men's football (97%), and they're fairly evenly spread out across non-league football (33%), professional leagues (32%), and elite level (25%). The final 10% of respondents work at amateur level.

Social networks

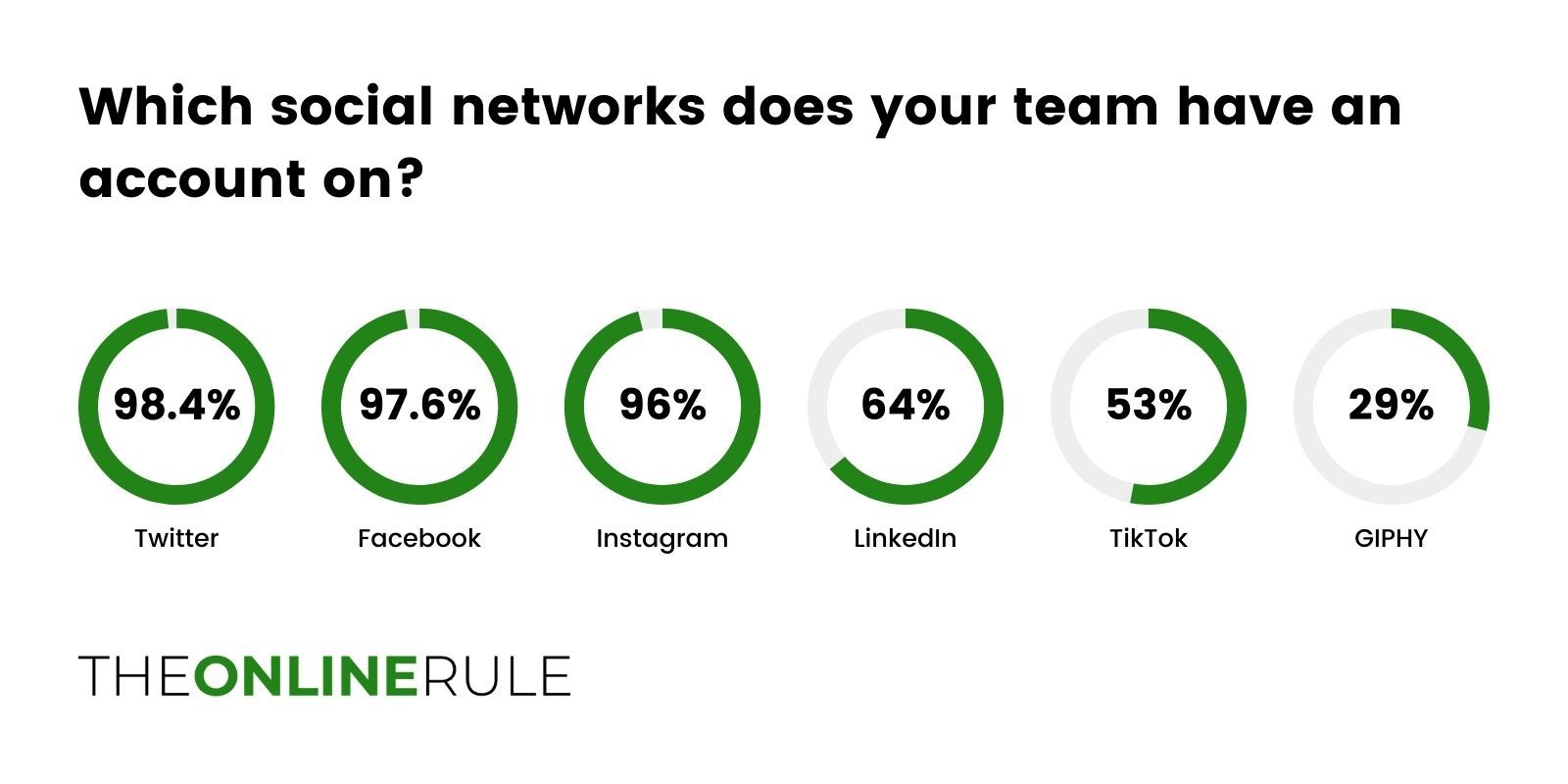

In terms of most popular social networks between teams, it should come as no surprise to see Facebook, Instagram, and Twitter out in front.

96% of teams are on Instagram, with 97.6% and 98.4% for Facebook and Twitter respectively. The biggest surprise here is that there isn't any platform sitting at 100%. I've no idea which teams aren't on any of those three channels, but it would be fascinating to know the reasons behind it. Last year both Facebook and Twitter hit 100%.

At present, LinkedIn ranks higher than TikTok (64% vs 53%), however I'd expect that gap to be smaller next year. LinkedIn hasn't really budged since last year (61%), however TikTok use has grown by 51% (up from 35% presence last time).

Further down the list, GIPHY (29%), Snapchat (16%), and Pinterest (2%) all appear.

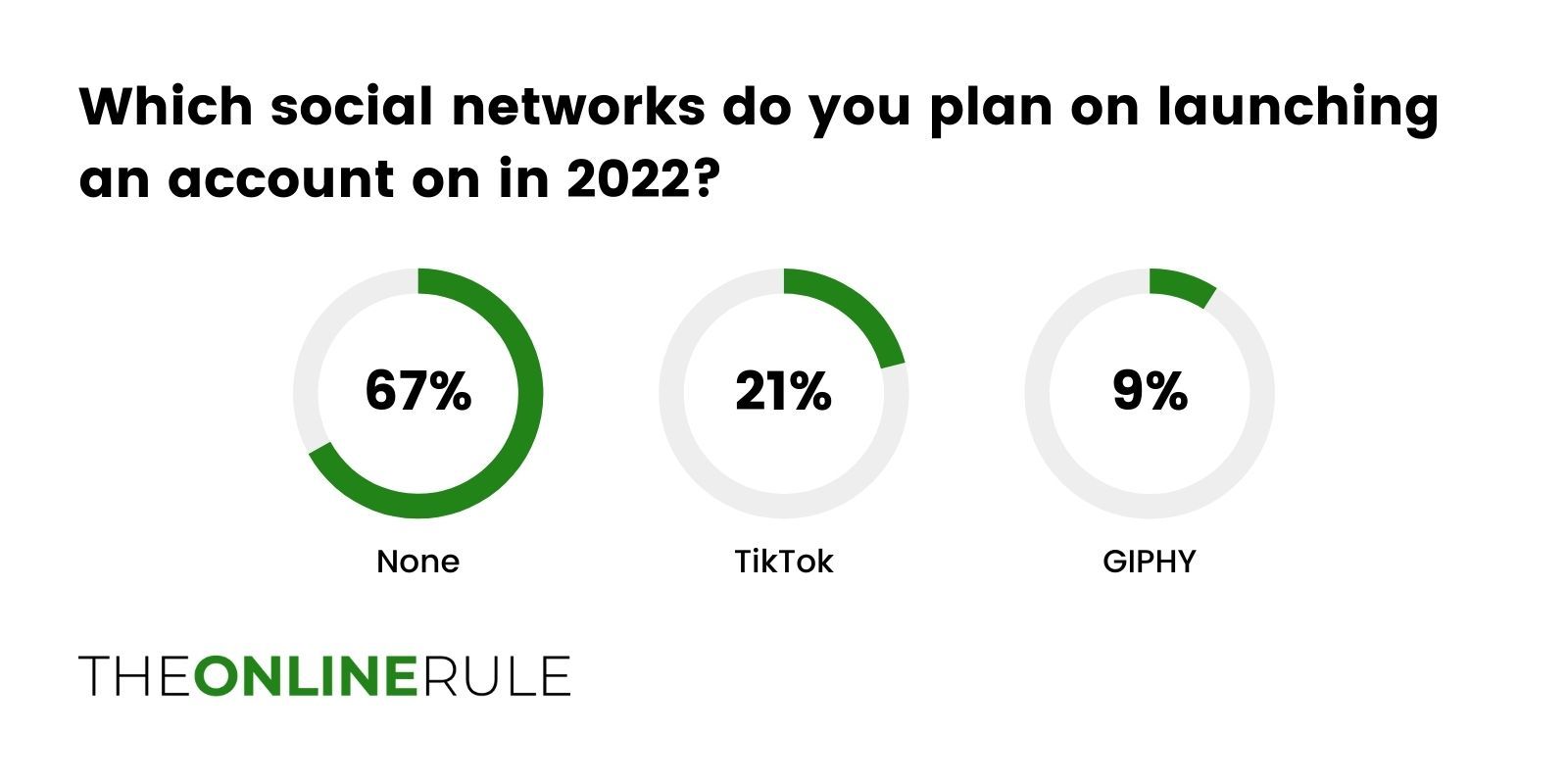

For next year, one channel stands out as the one teams are planning to launch on: TikTok (21%). After that it's GIPHY at 9%, with everything else at 3% or lower.

Facebook (1%), Instagram (2%), and Twitter (1%) appear here, suggesting that the teams from earlier who aren't on it won't be staying that way much longer.

An overwhelming 67% of people say they won't be launching on any new channels in 2022.

Paid advertising

I've long been fascinated with paid advertising in sport. In November 2021 I trawled through the transparency reports for the 20 Premier League clubs to look at how they were using Facebook ads. At that point, 18 of the clubs were using ads (Burnley and Newcastle were the odd ones out).

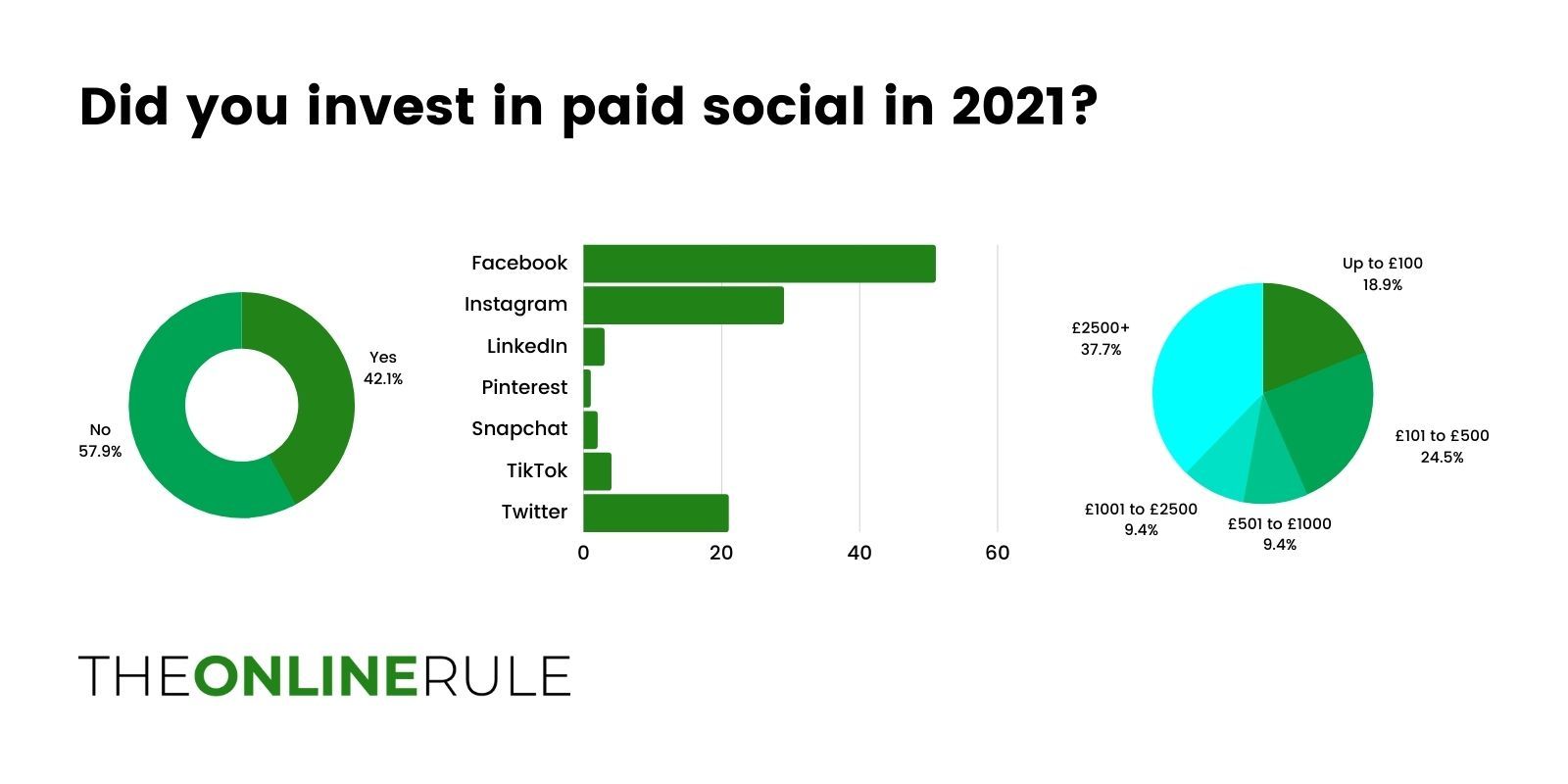

42% of respondents said that they invested in paid social advertising in 2021. Of these, 96% said they were using Facebook, 55% were using Instagram, and 40% were using Twitter. Paid social use drops off after that, with TikTok (8%) next on the list.

Paid social use is fairly spread out across the levels too. 14 respondents from amateur and non-league clubs invested in it in 2021, with most spending a maximum of £500 over the year. One club did spend more than £2,501, which was more than eight elite clubs. It's no surprise to see that most spending among the elite level was in excess of £2,501.

In terms of total budgets, 38% of teams spent more than £2,501 advertising on social media in 2021. Last year that number was only 26%, a 46% increase in the highest budget year on year.

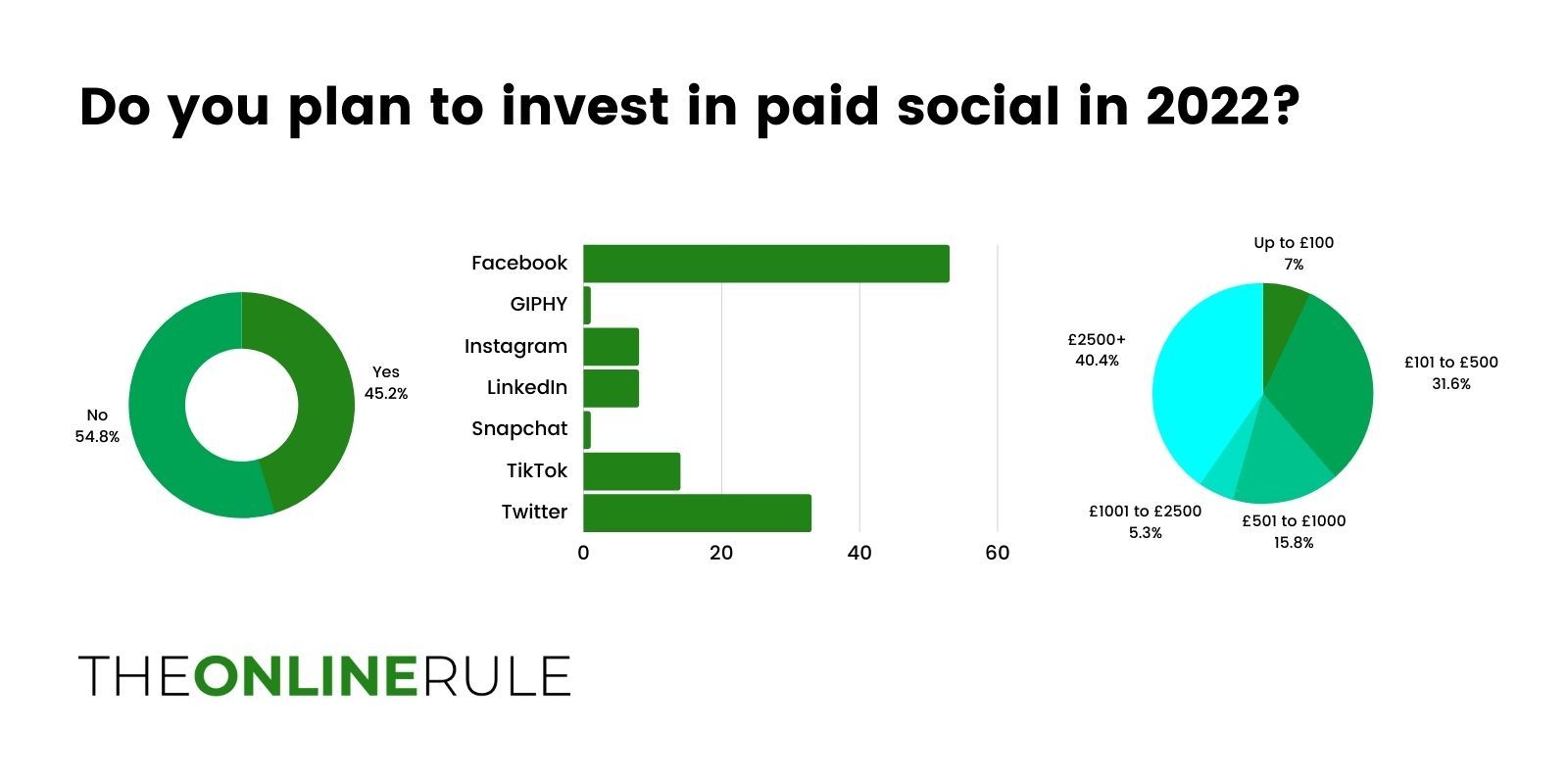

For 2022, 40% of teams say they have a budget of more than £2,501 to spend over the next 12 months. TikTok and LinkedIn have higher numbers than 2021 here, with 25% of respondents planning to invest in TikTok, and 14% planning to spend in LinkedIn. The overwhelming majority (93%) will be using Facebook ads.

Of the 73 teams who didn't do any paid social in 2021, seven state that they'll be moving into that area in 2022. So we can expect to see those numbers start to increase.

Content plans

The next question was based around the types of content that staff would like to spend more time producing over the next 12 months.

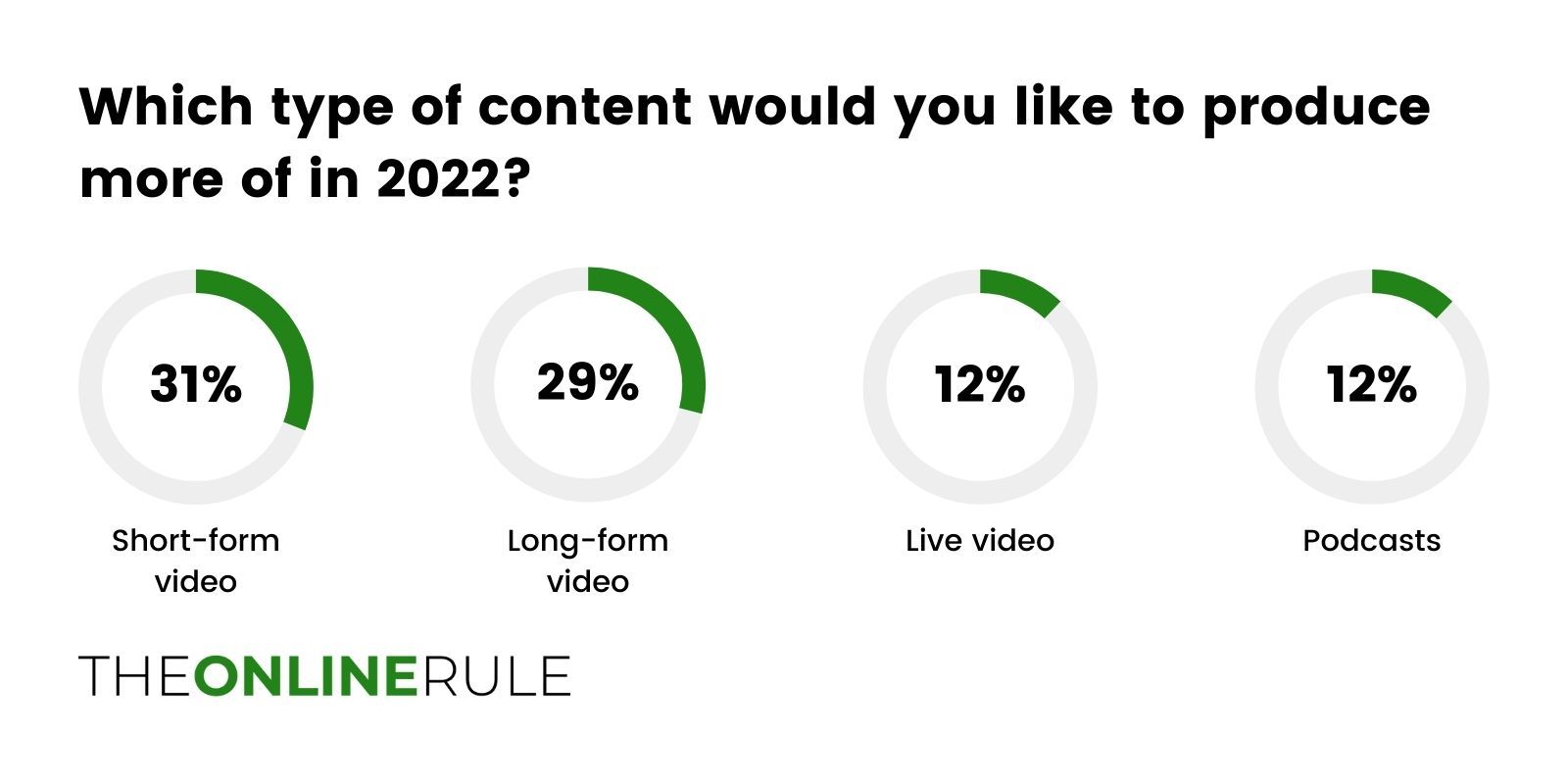

Video features highly here, with 31% prioritising short-form video (defined as a maximum of 30 seconds), and 30% looking at using long-form. Podcasts and live video are tied on 12% each, with content such as GIFs, Stories, written content, and images at the bottom.

The focus on video and podcasts isn't hugely surprising, as both have seen a lot of growth over the past 12 to 24 months. Clubs are regularly producing their own podcasts, with their access to current and former players proving a huge draw to fans.

Measuring success

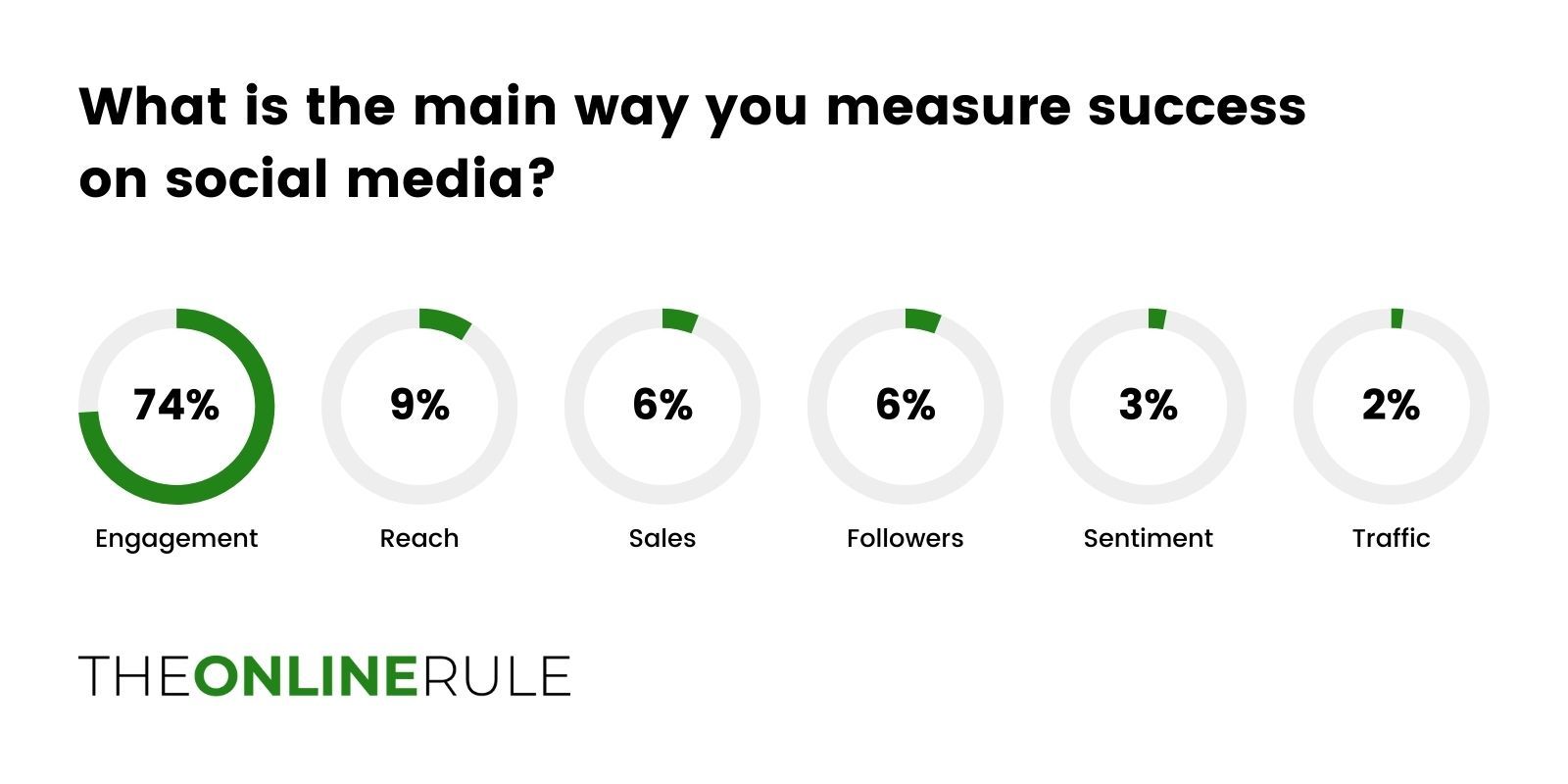

In terms of measuring and reporting on what's working on their social channels, teams prioritise engagement over anything else (74%). Like last year, that remains the main metric.

A few more teams are tracking sales as a sign of success, but on the whole it's all about the engagement.

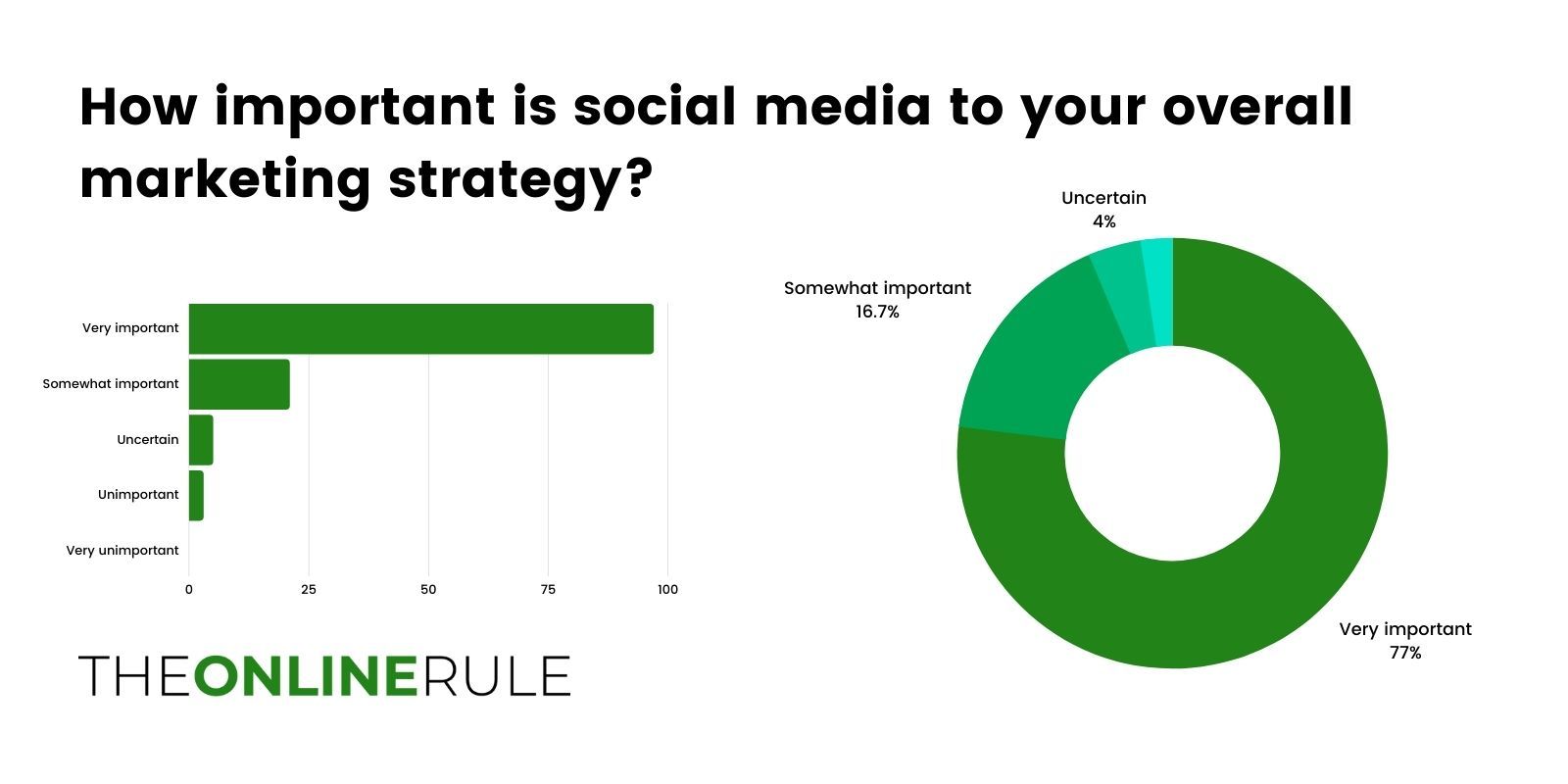

Social media remains important to teams' overall marketing strategies, however. 77% say that it's very important to their marketing, with 17% saying it's somewhat important.

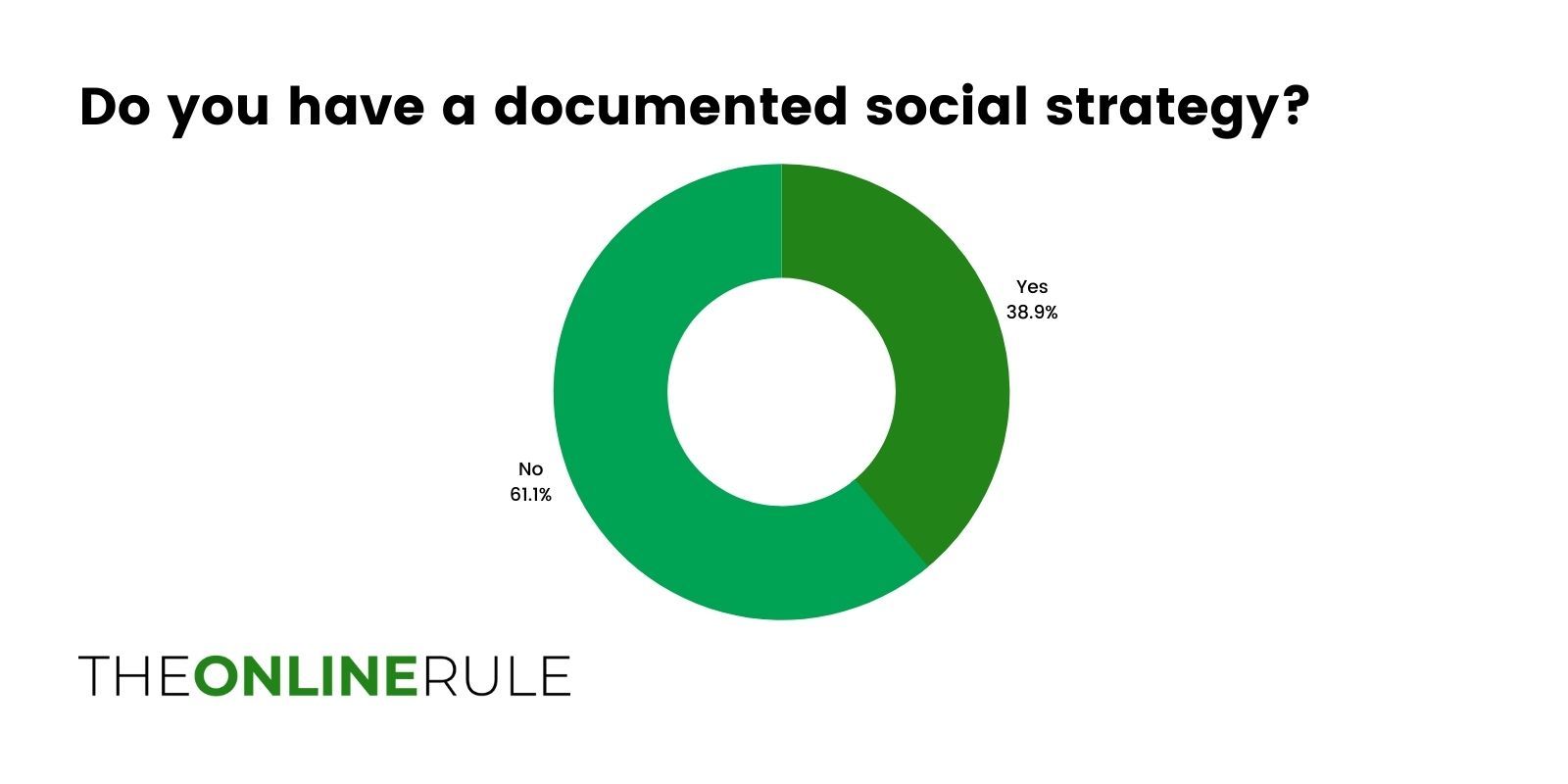

Finally, 61% of teams don't have a documented social media strategy, an increase from 58% last year. Of the 118 respondents who said that social media was either very important or somewhat important, 69 (59%) said they don't actually have a documented social media strategy. This includes nine clubs at elite level and 26 in the professional leagues.

Conclusion

If you want to access the full data, you can view the Google Sheet here.

If you come up with any additional findings that you think are of interest, please share them with me on Twitter. And if you use any of the data publicly, it would be appreciated if you could link back to this page and mention the site.

You can scroll through the charts in a Canva embed below.