The State of Football Social Media 2023: The results

This year's State of Football Social Media survey is over, and you can view the results from football social media managers around the world.

This year's State of Football Social Media survey is now over. Thanks to the 63 social media managers who took the time to answer a few questions on how their teams use social media.

This time around there were a few new questions. One of the biggest ones was asking contributors to let us know how important each network is to their marketing.

Respondents came from 10 different countries, with answers spanning all levels of football and in both the men's and women's games. 16% of the people who completed the survey this year work at clubs where they are the only member of their marketing team.

What follows is an overview of the responses, along with an interactive report where you can dive deeper into the results. This interactive report allows you to filter responses by country, club level, and team size.

You can also see the results from 2022 and 2021.

Social networks

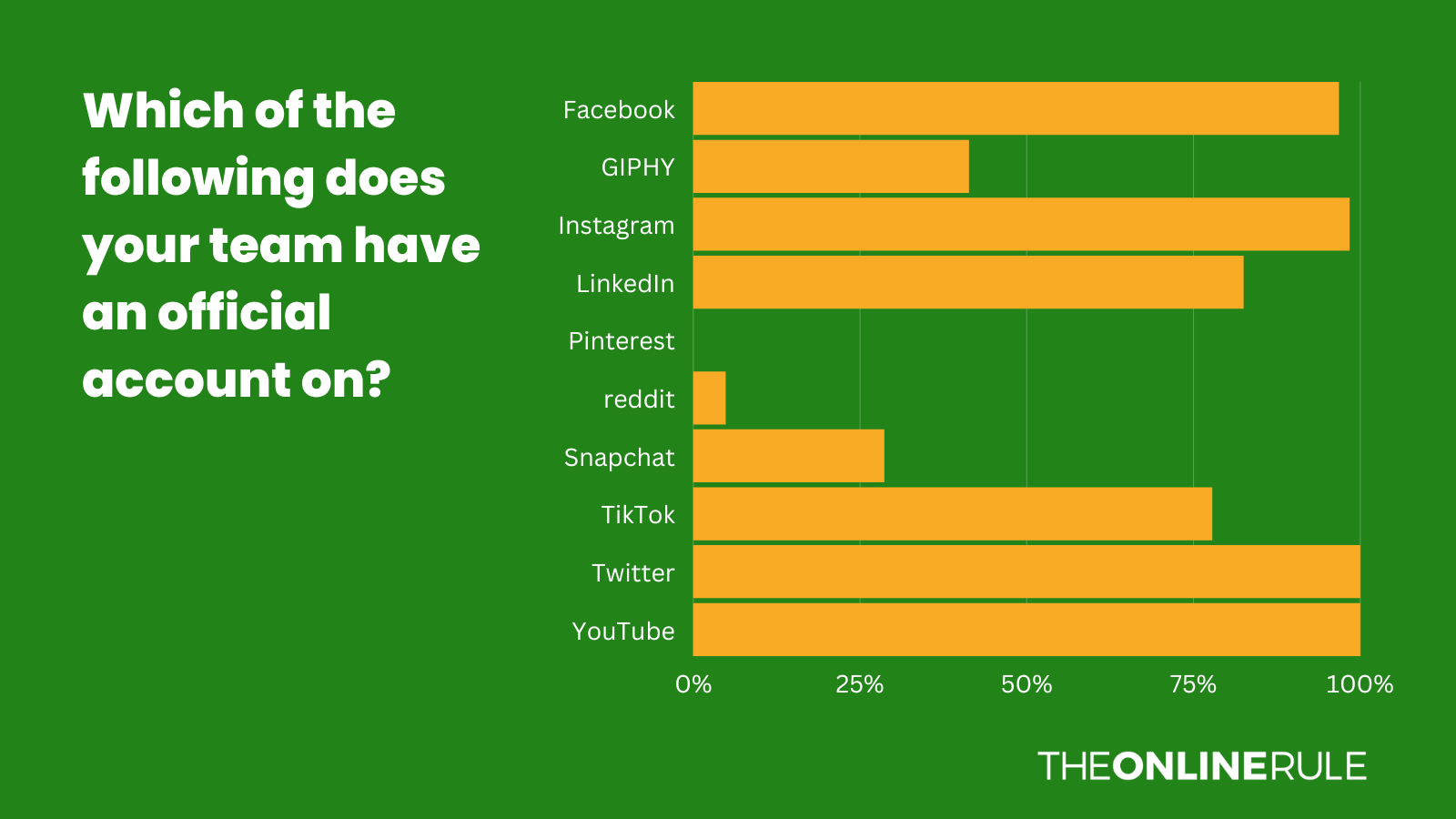

To start things off, I asked which networks teams had an official presence on.

Last year, 53% of teams had an official account on TikTok. This year, that number has grown to 78%. The only channels that had a 100% response were Twitter and YouTube.

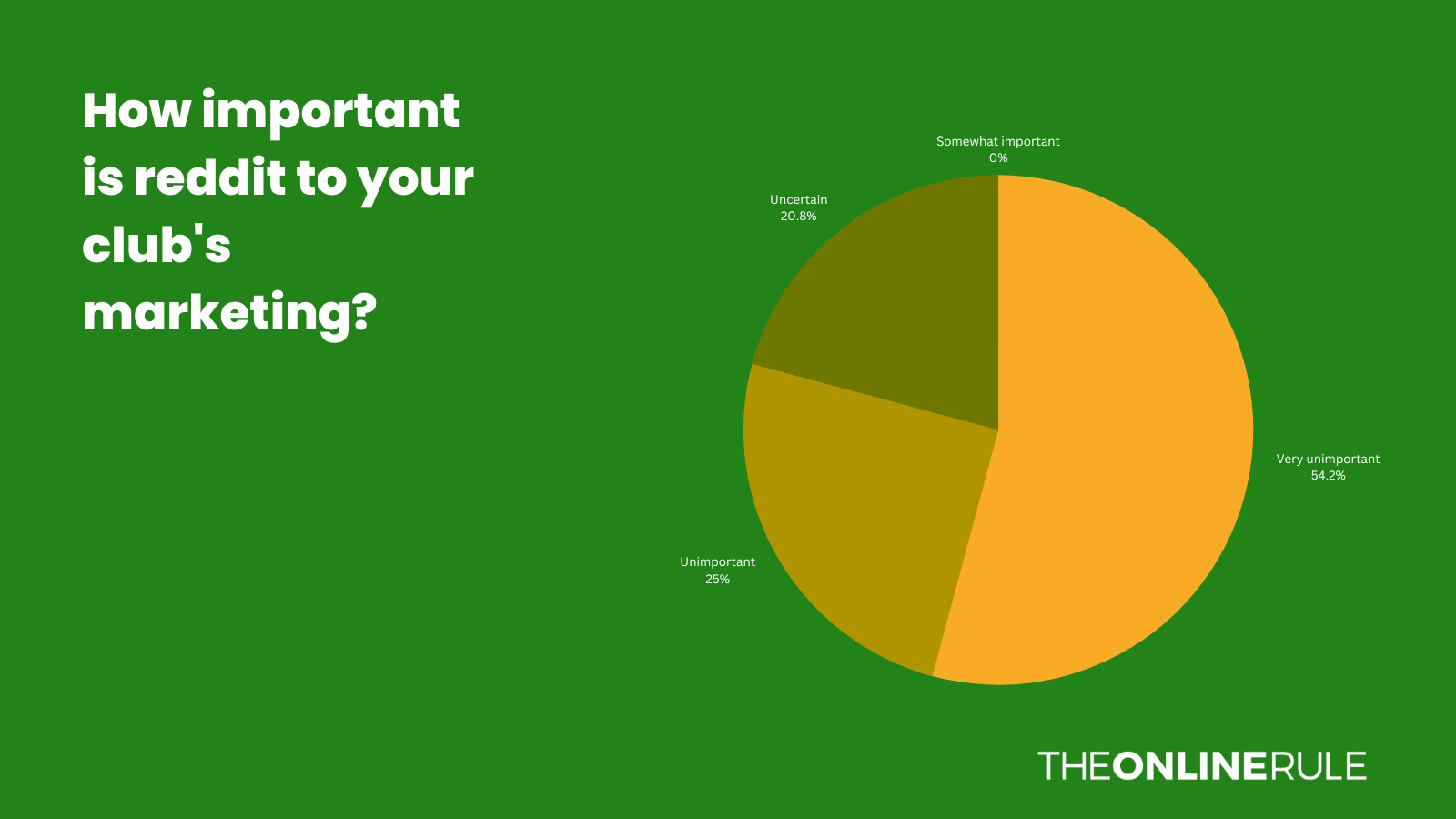

Interestingly, three teams said they had an official presence on reddit. It's the first time I've included that in the survey, but given I'm a big believer in teams focusing on community management it's one that I'll be keeping an eye on over the next few months.

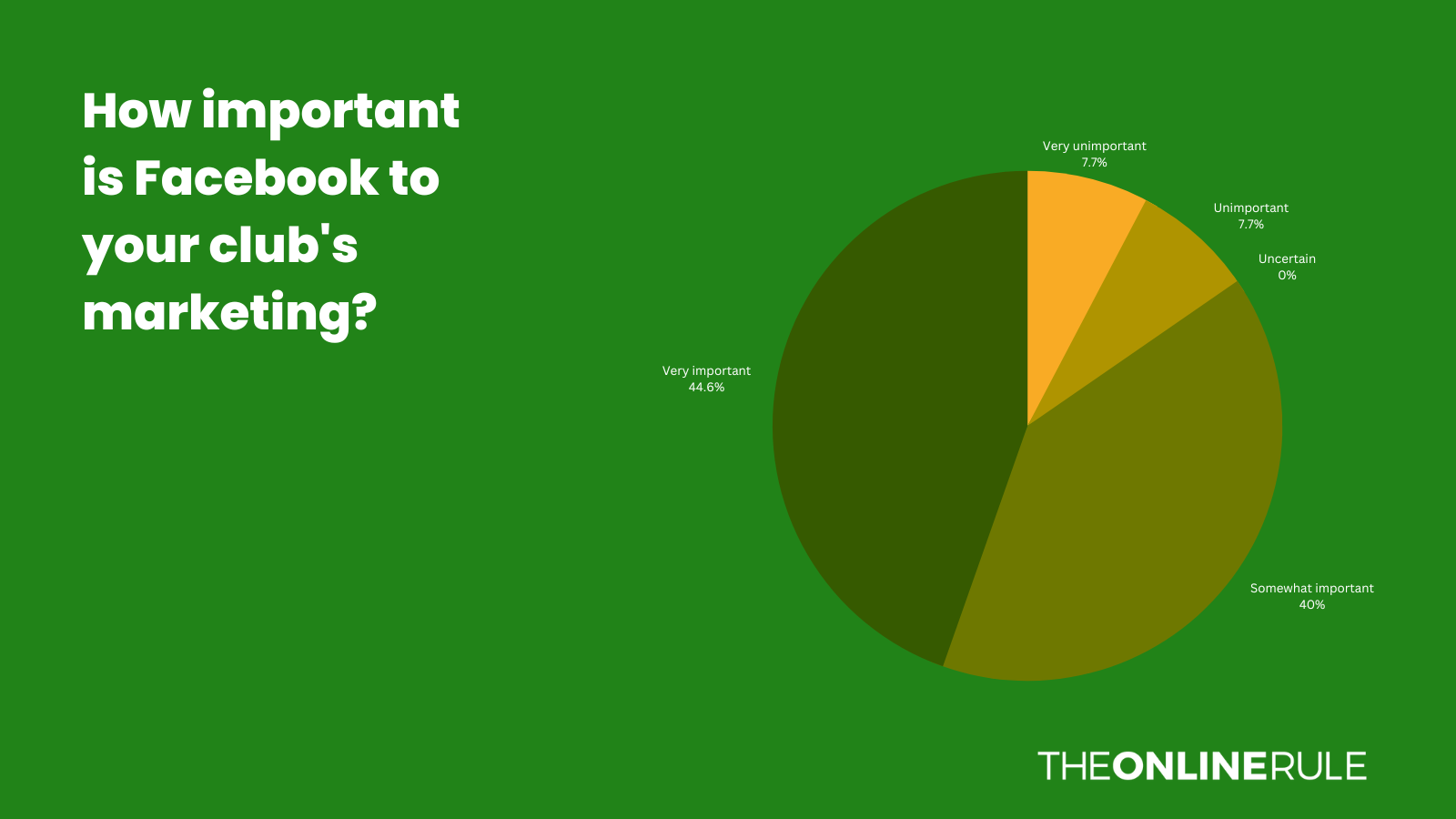

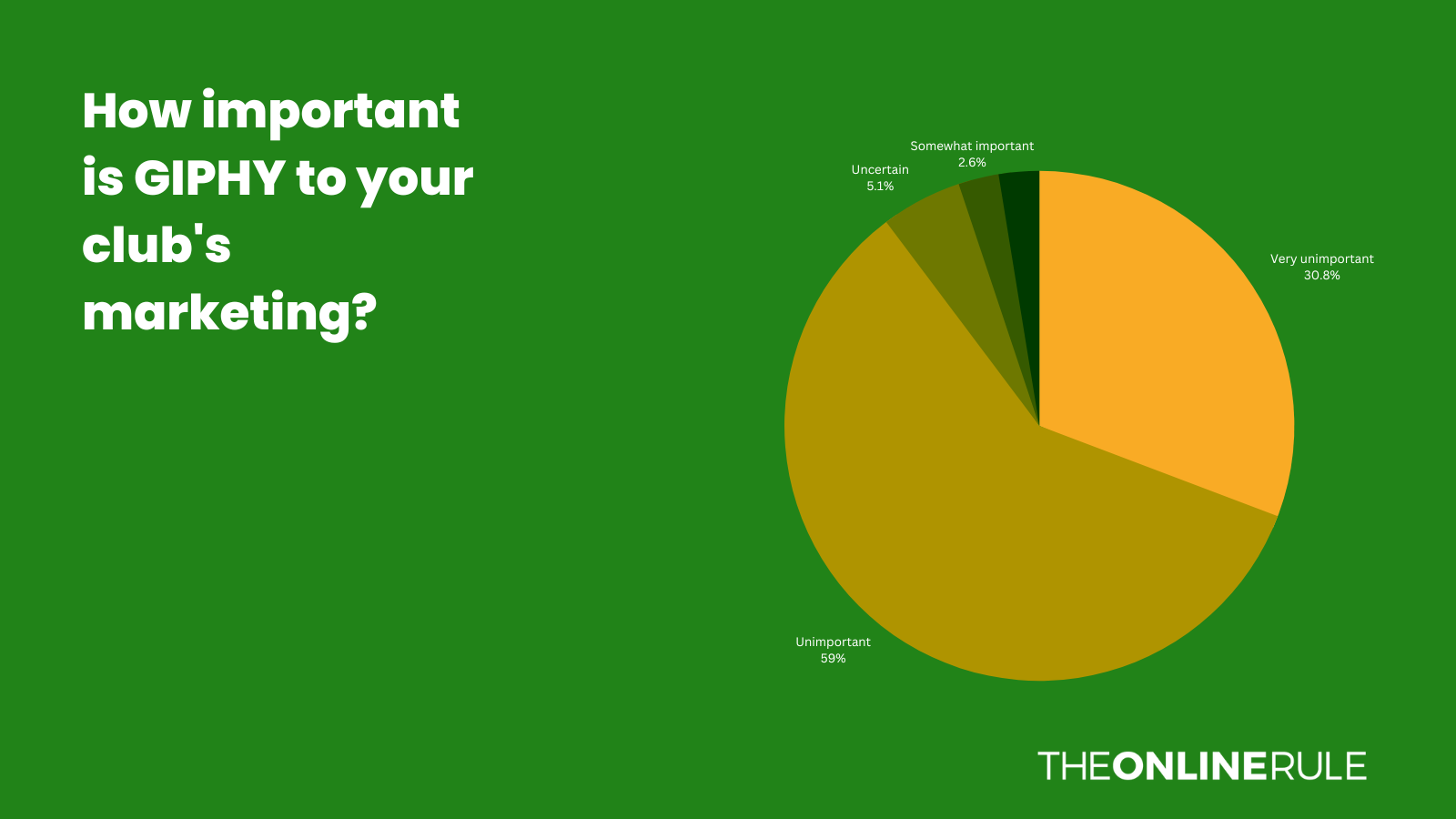

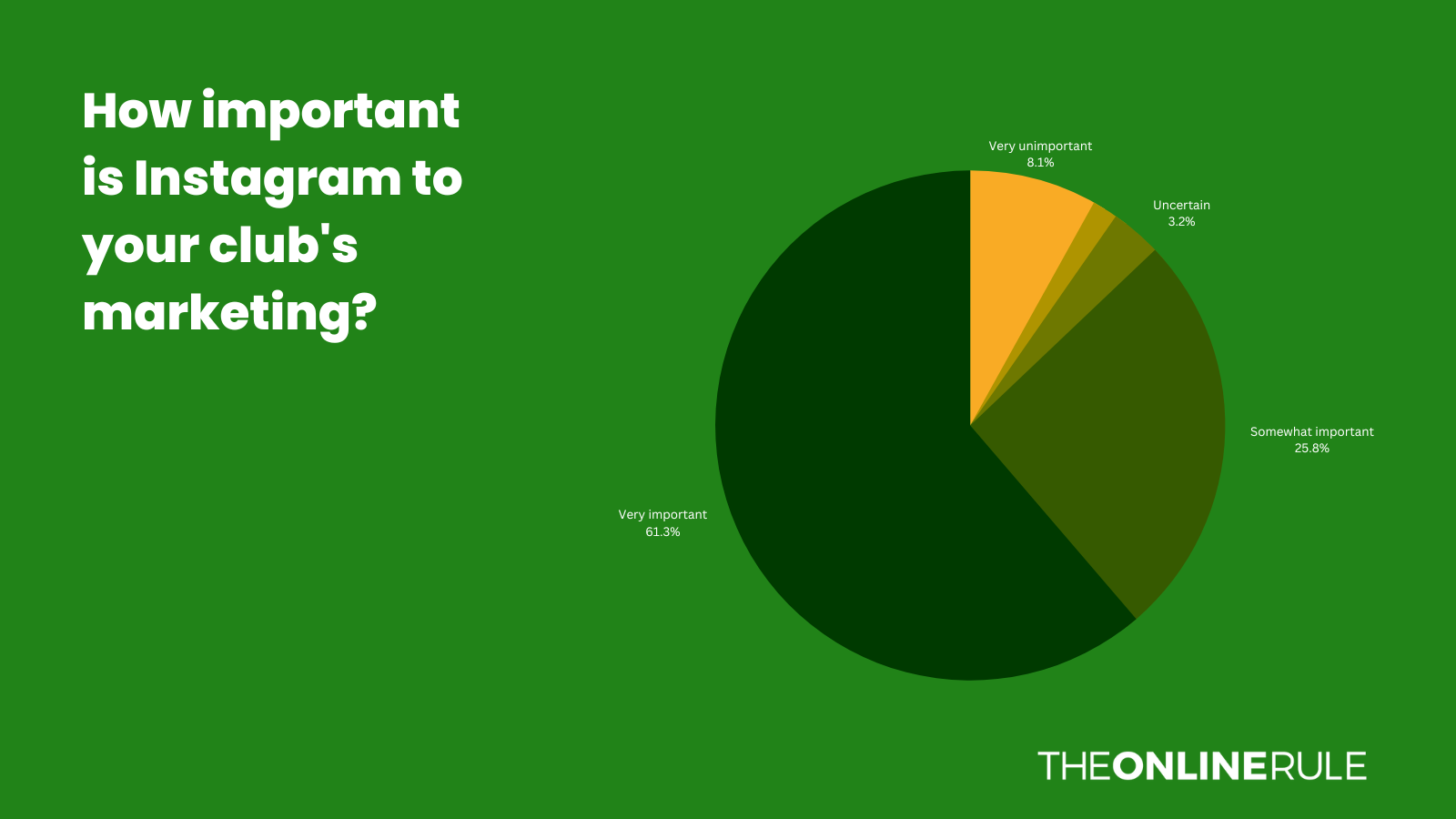

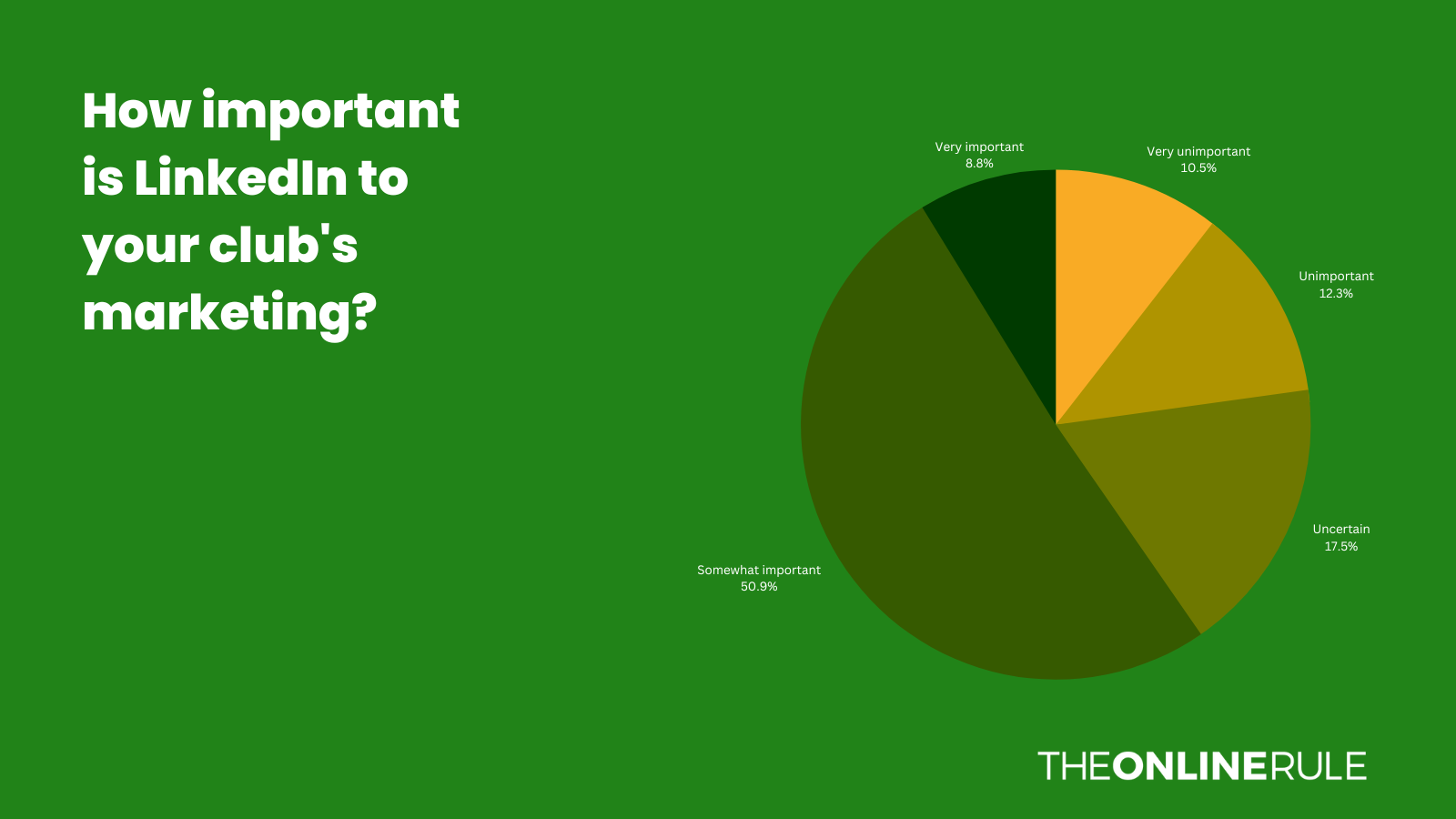

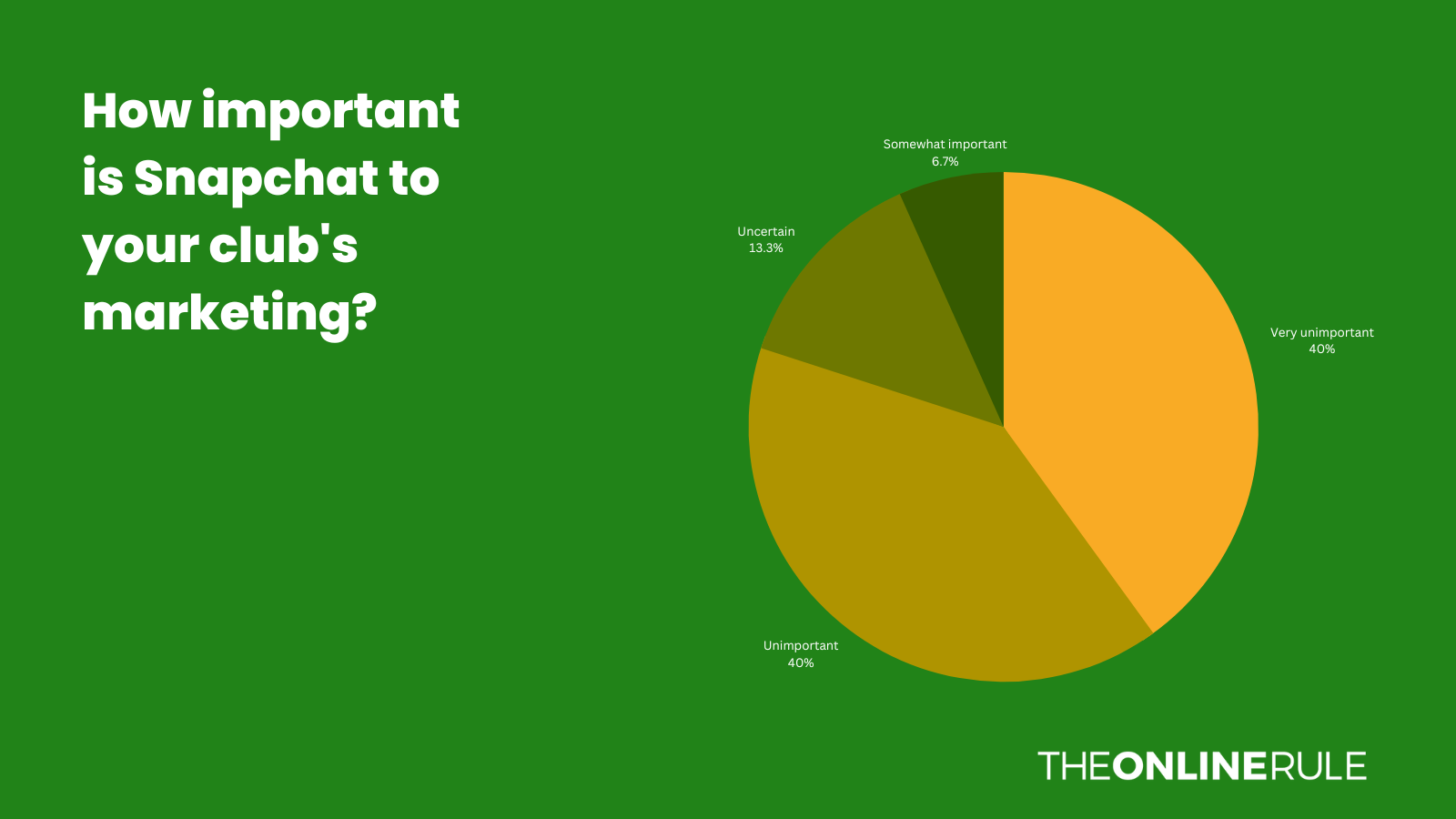

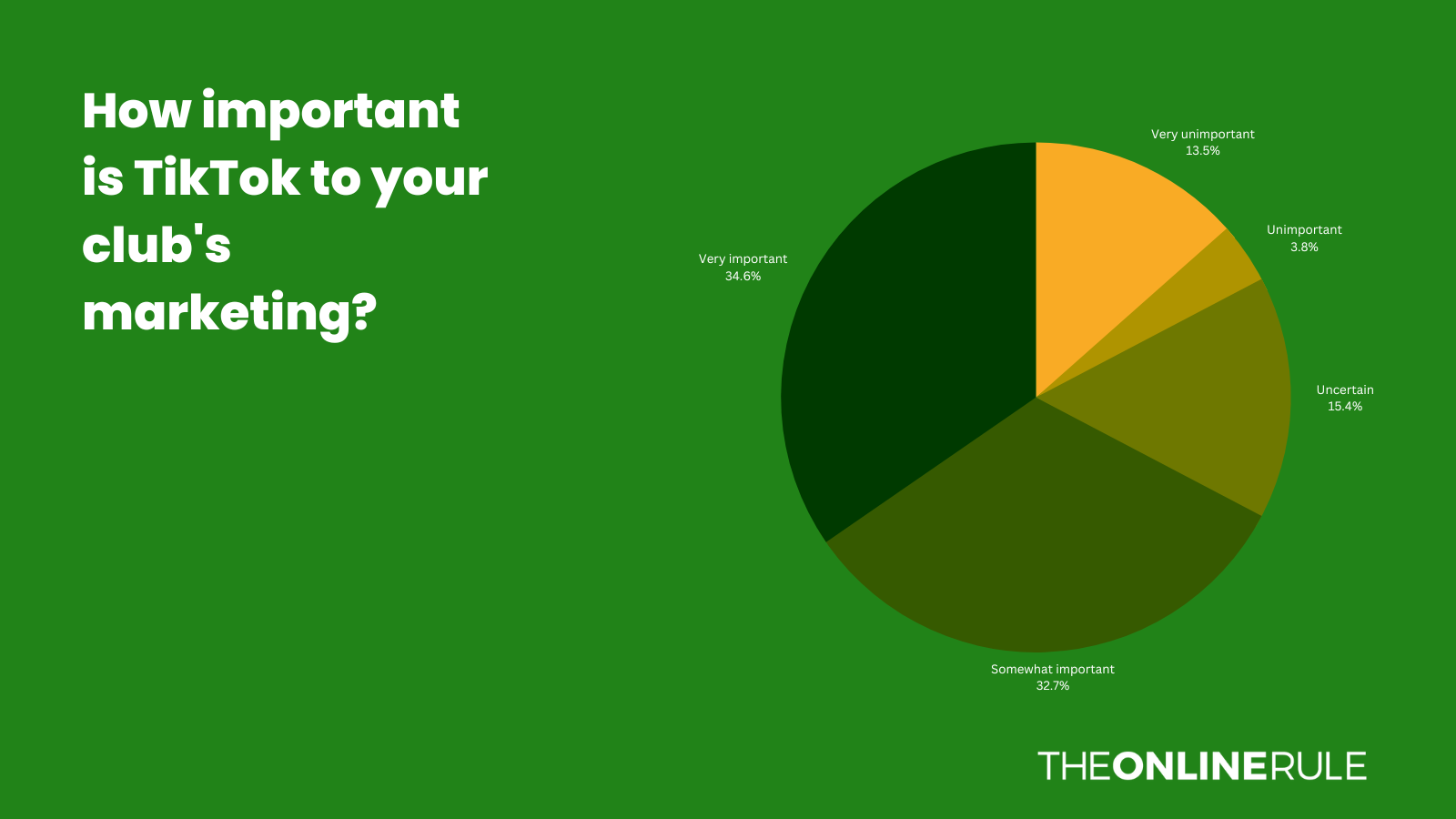

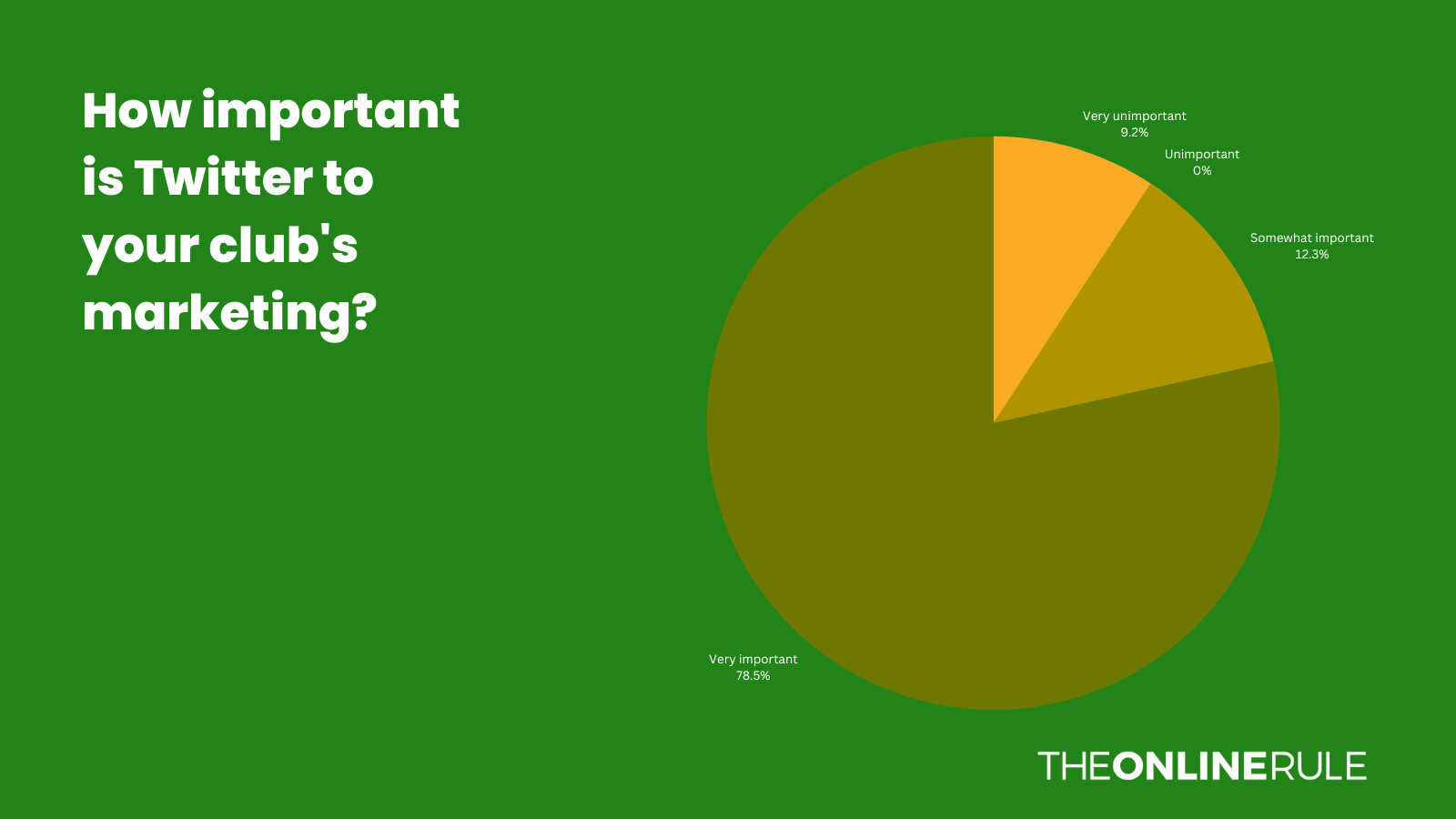

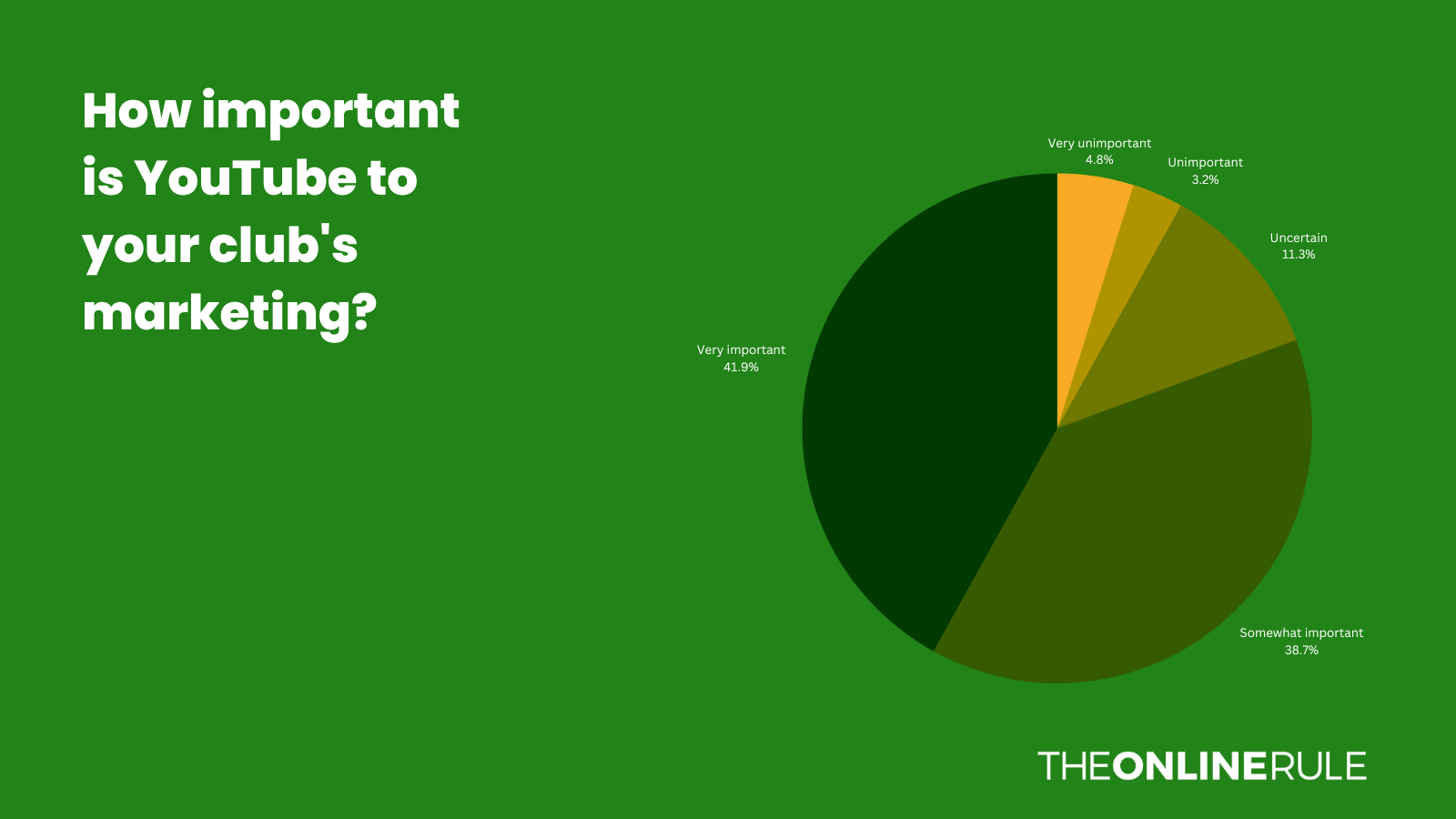

In terms of importance, Twitter came out by far the most important network to clubs. There are nine graphs below that you can click to make bigger and view in more detail. I've left out Pinterest as no clubs said they were on there, so that really answers the question of importance.

Clubs were asked to rank each channel on a scale of very unimportant, unimportant, uncertain, somewhat important, and very important.

Twitter had the highest percentage of 'very important' responses (78%), followed by Instagram (61%), Facebook (45%), and YouTube (42%). TikTok was slightly behind those (35%), which was surprising, and I wouldn't be surprised to see that number increase over the next 12 months.

In terms of new launches, 13% of respondents said they were planning on launching a TikTok channel in 2023. One club also said they would be launching a further TikTok to complement the one they have already.

Two teams said they were planning on launching an official reddit account, with another three saying BeReal was on their radar.

Influencer marketing

A few new questions this year.

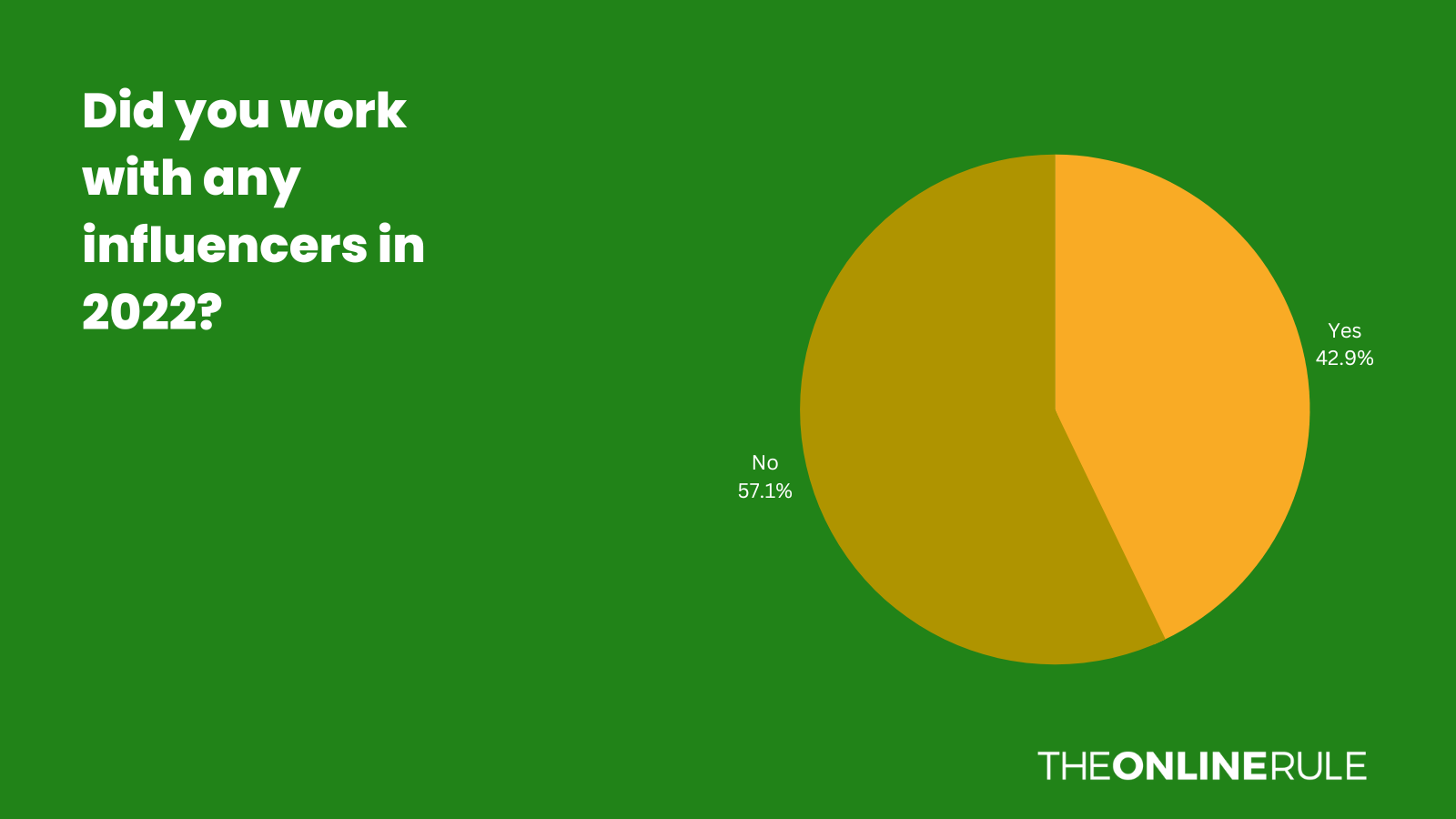

First, I asked how many clubs had worked with influencers in 2022. I always think it's important to be transparent about partnerships like these. They're obvious when you spend time looking over content, but a snapshot makes it easier for people to see if it's particularly widespread.

43% of respondents said they'd worked with influencers. Usage of influencers changes depending on the level of the teams.

61% of teams categorised as elite said they'd used influencers, compared to 46% at professional level, 8% at non-league level, and 0% at amateur level. Given the costs often associated with influencers, this drop as you move down the levels isn't a huge surprise.

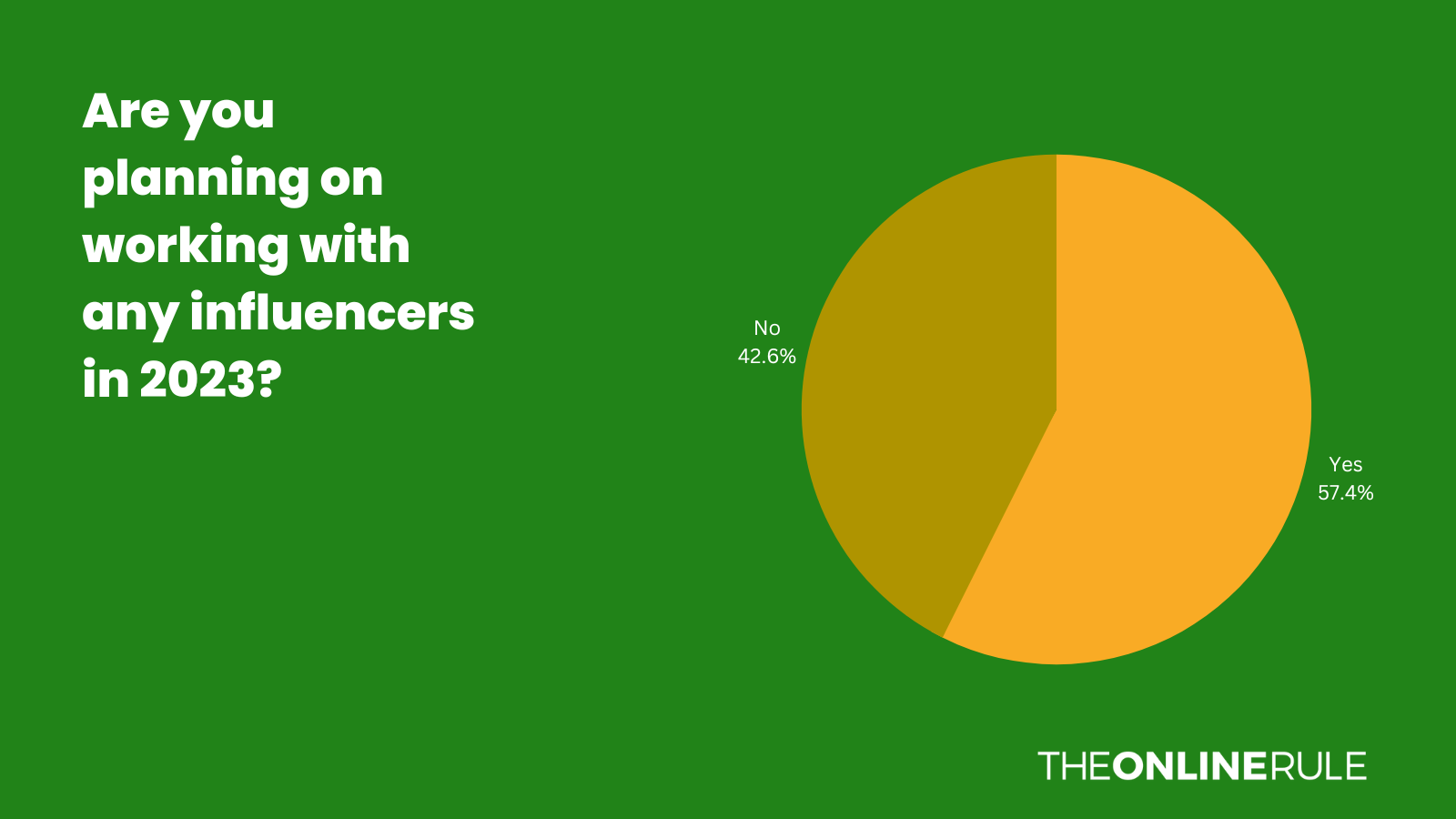

When it comes to 2023, 57% of teams said they were planning on working with an influencer.

Once again this peaks among elite level teams (78%) before declining as we progress down the levels.

Email newsletters

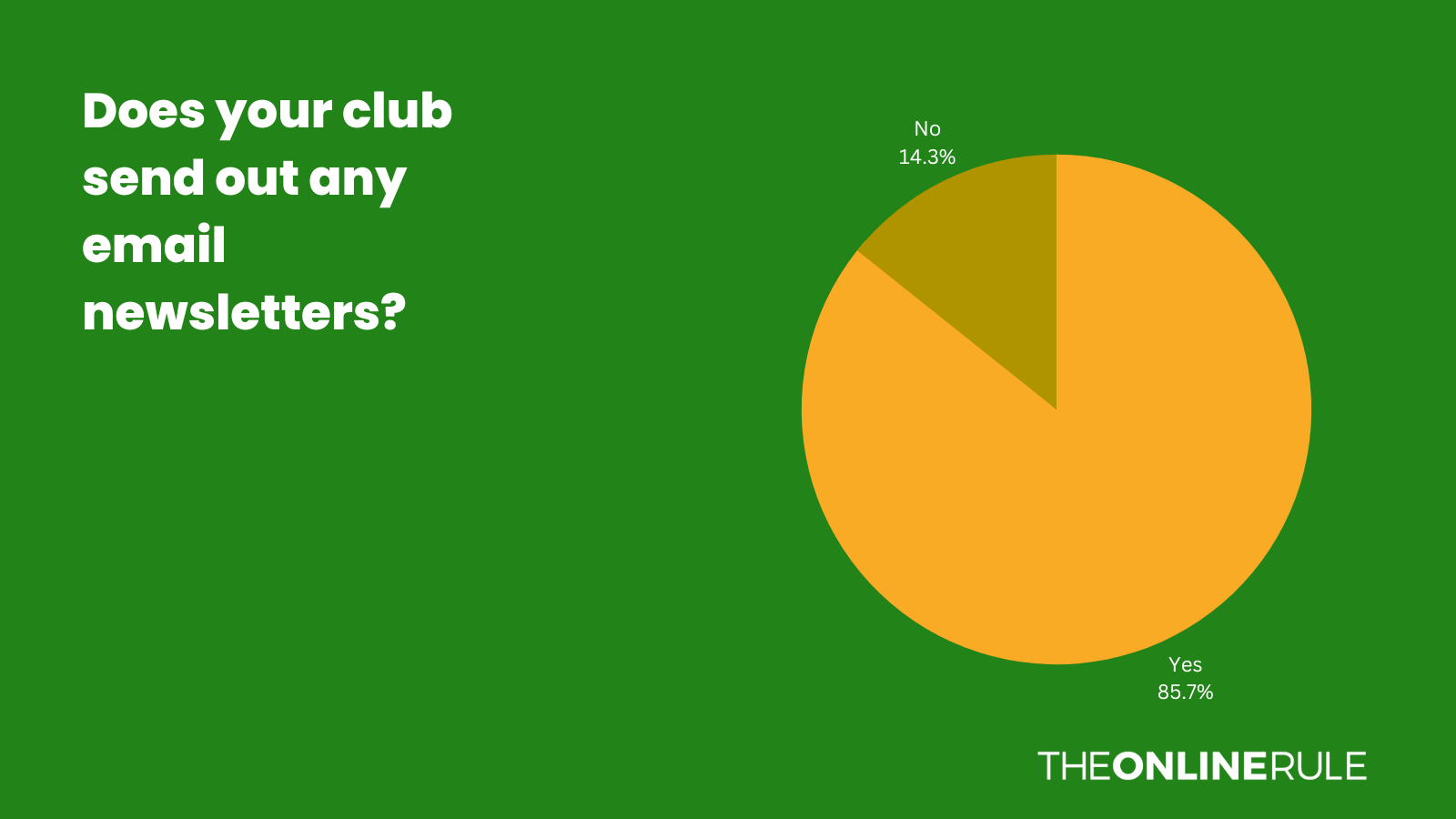

While it's not social media, I did want to get a sense of the number of teams regularly using email marketing to engage with their fans.

For a lot of businesses email is among the highest converting channels. 86% of teams who responded said they sent out regular emails. This breaks down as:

- 96% of elite level teams

- 86% of professional level teams

- 67% of non-league teams

- 50% of amateur teams

There are free, or relatively low cost, email platforms. Getting people subscribing and communicating with them regularly can be a cost effective way of increasing ticket and merchandise sales, as well as giving you another platform to send updates and news out via.

Paid social media

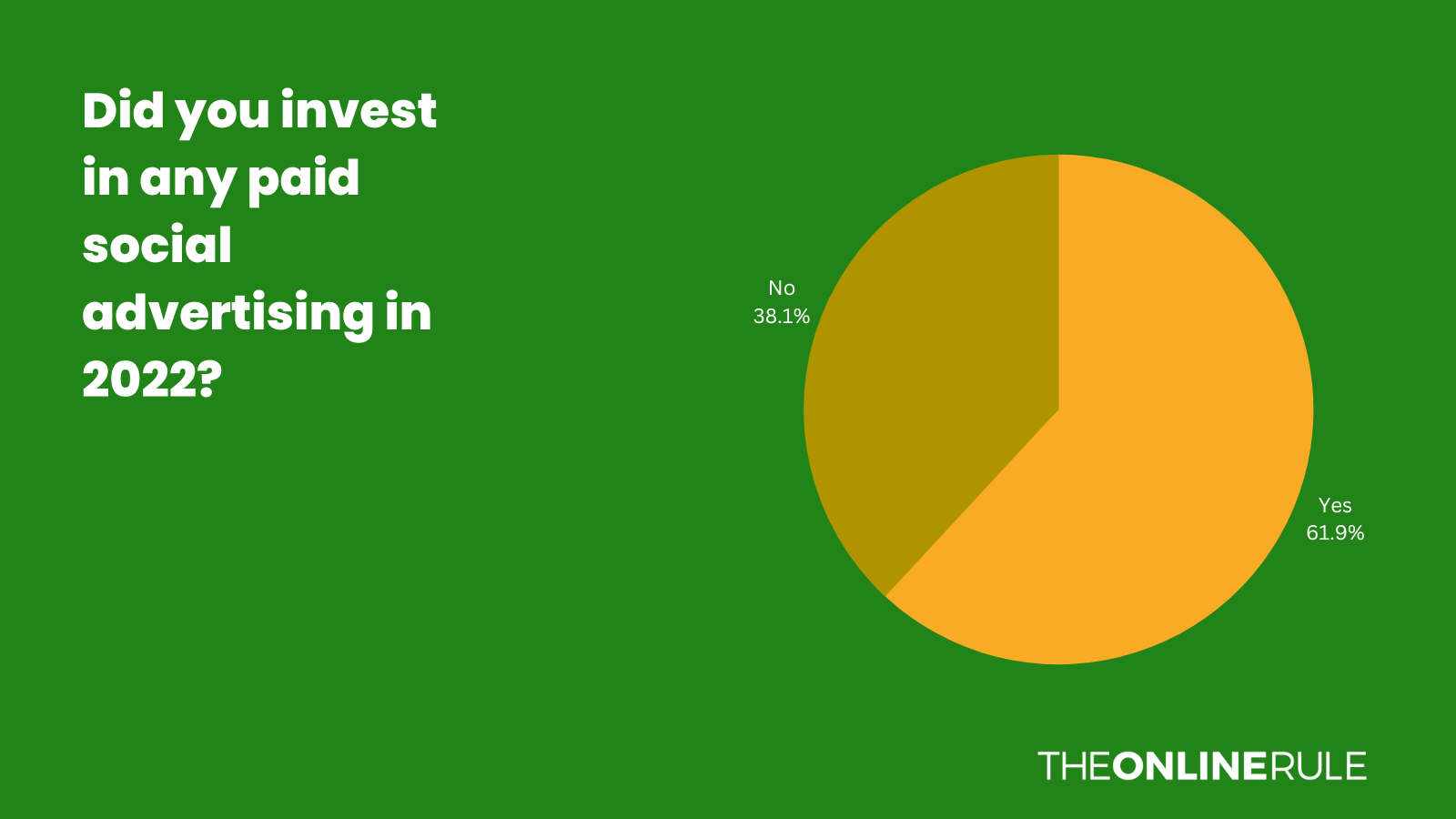

I really enjoy digging into the percentage of teams that are using paid social media in their marketing efforts. Organic social media gets pretty much all the attention, yet last time I checked 18 of the 20 Premier League clubs were actively advertising on Facebook.

I've previously spoken to the agency helping Sheffield FC with their paid social, and earlier this year we also ran a piece from Southampton's Digital Marketing Manager Chris Samson with useful tips to help teams get started. Paid advertising is an essential part of the marketing efforts for the majority of businesses, and football clubs should be no different.

Among respondents, 62% of teams said they had used paid social media in 2022. Meta's platforms were the most used - 95% for Facebook, and 62% for Instagram - followed by Twitter (49%), TikTok (21%), LinkedIn, and YouTube (both 10%).

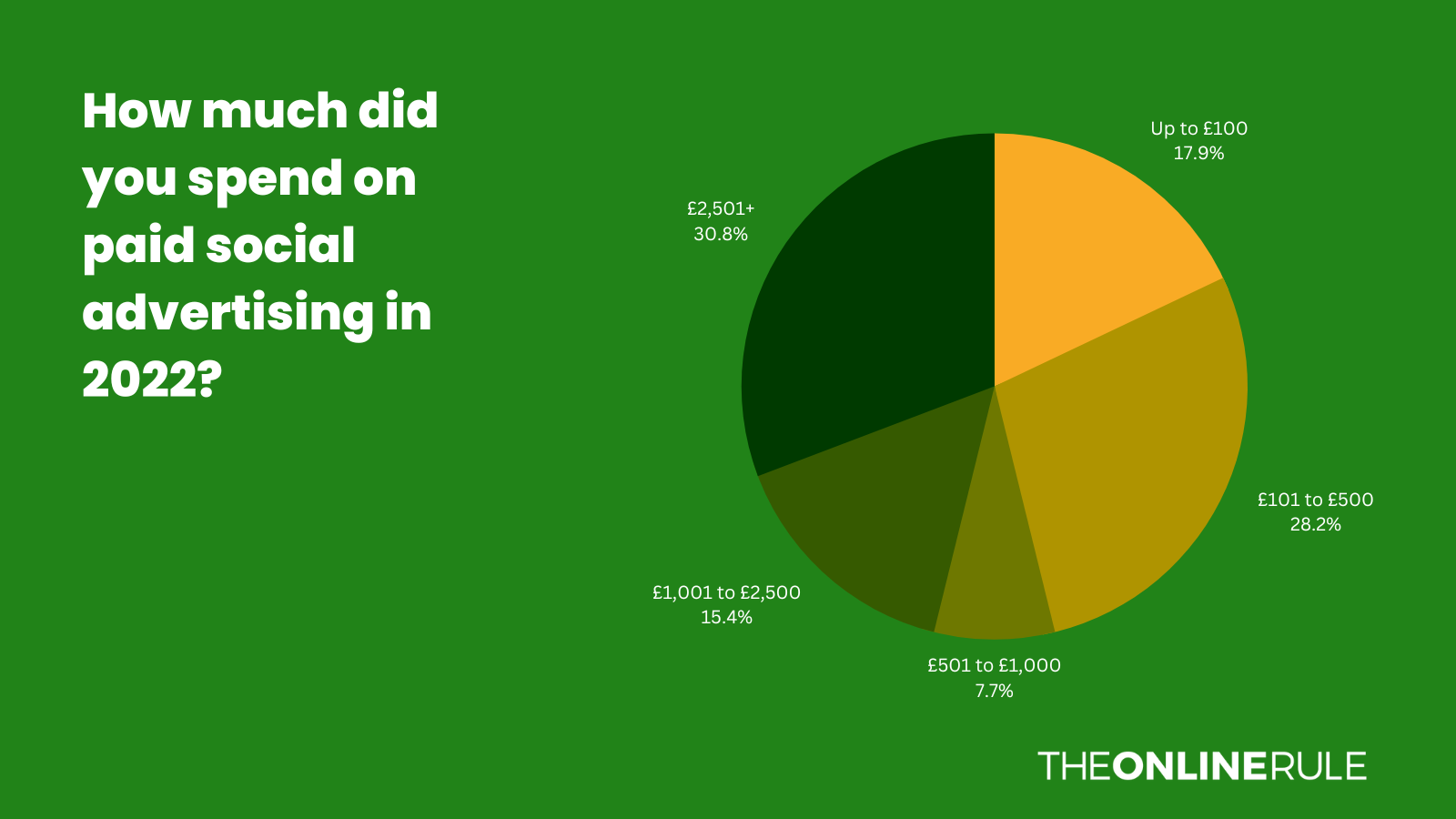

31% of teams reported a paid social spend of more than £2,501. This was reported by 55% of elite level teams, with a total of 75% reporting a spend of over £1,001. This drops to 23% of professional level teams, and 0% of non-league and amateur teams. Among those that ran ads at amateur level, all spent between £101 and £500.

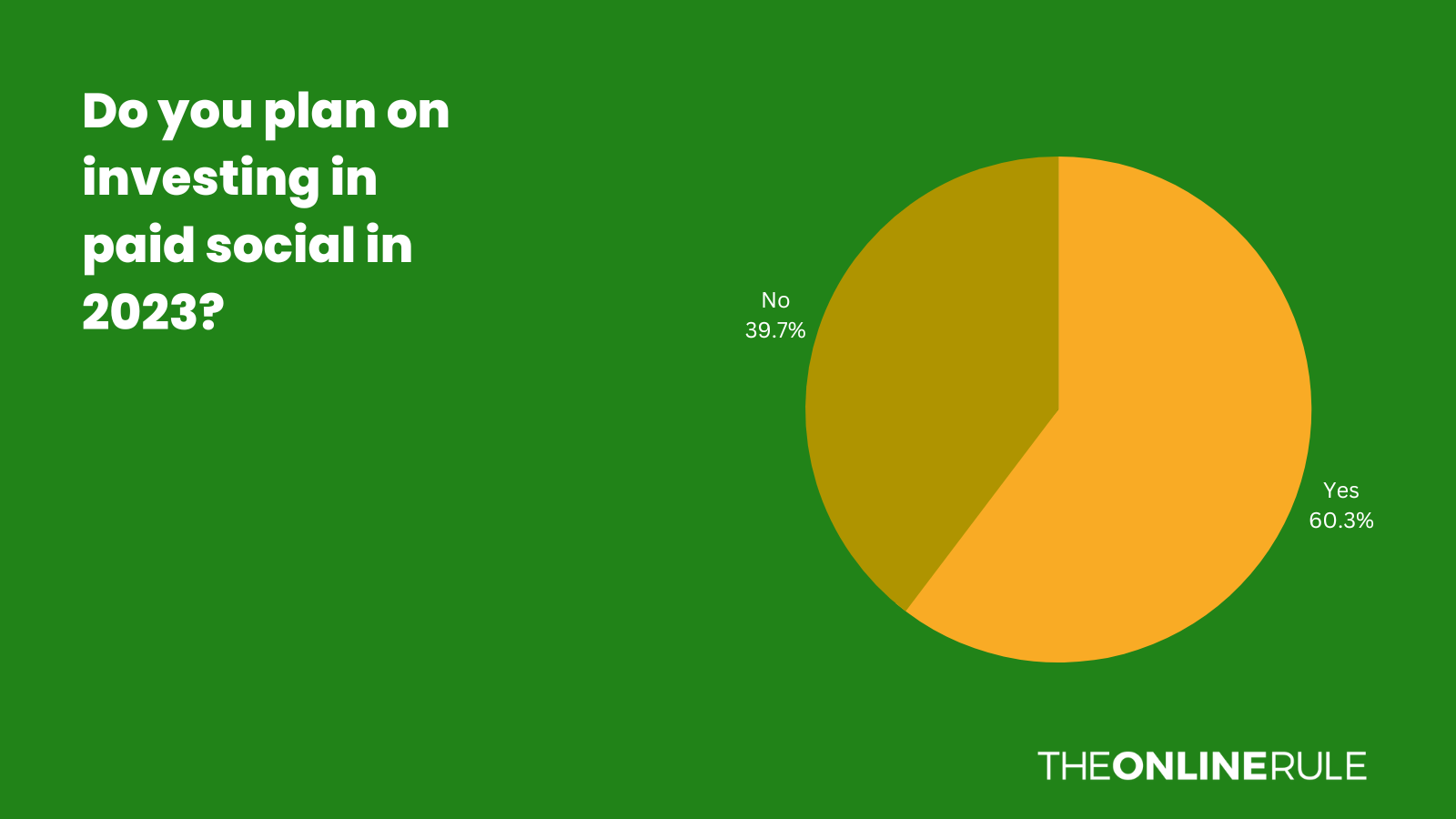

Looking ahead to 2023, the numbers are roughly similar. 60% of teams plan to invest in paid social this year, with 90% saying Facebook is their platform of choice.

While there were six platforms mentioned by teams in 2022 (Facebook, Instagram, LinkedIn, TikTok, Twitter, and YouTube), nine are mentioned as being in teams' thoughts for this year.

Facebook and Instagram remain the top channels for paid social (90% and 76% respectively), with TikTok looking more appealing than it was last year (32% compared to 21%).

Twitter still ranks well (53%), despite the Musk-induced turmoil the platform has suffered with for the past few months. It's clear from the figures that teams see Twitter primarily as an organic channel.

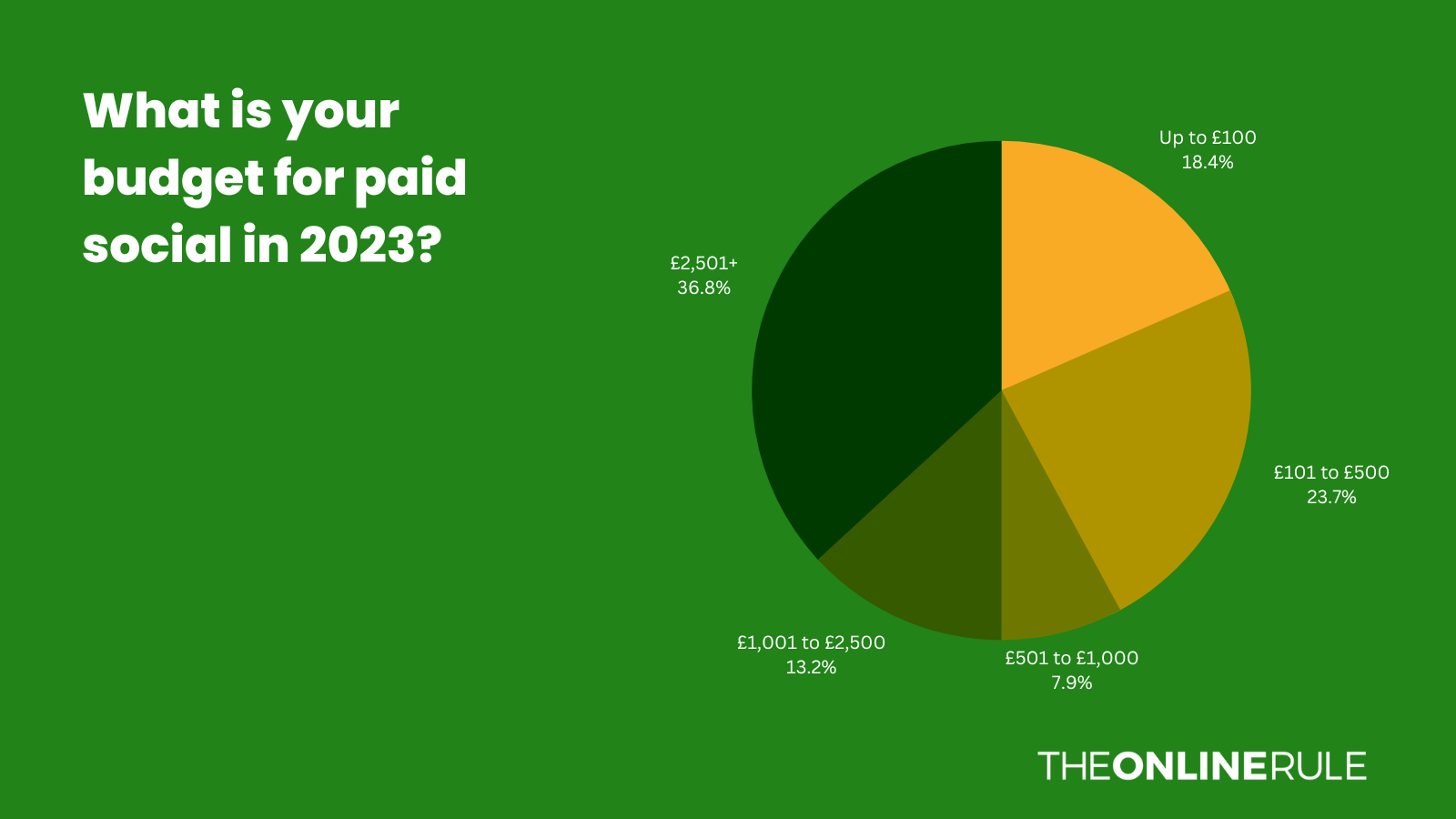

41% of teams say they have a paid social budget of £2,501, which is an increase on 2022's ad spend. 78% of elite teams plan to spend money on ads this year, compared to 54% among the professional level, and 58% at non-league level.

Content creation

Rather than asking for predictions about what teams expect to be popular, I prefer asking which types of content people would prefer to be producing over the coming 12 months.

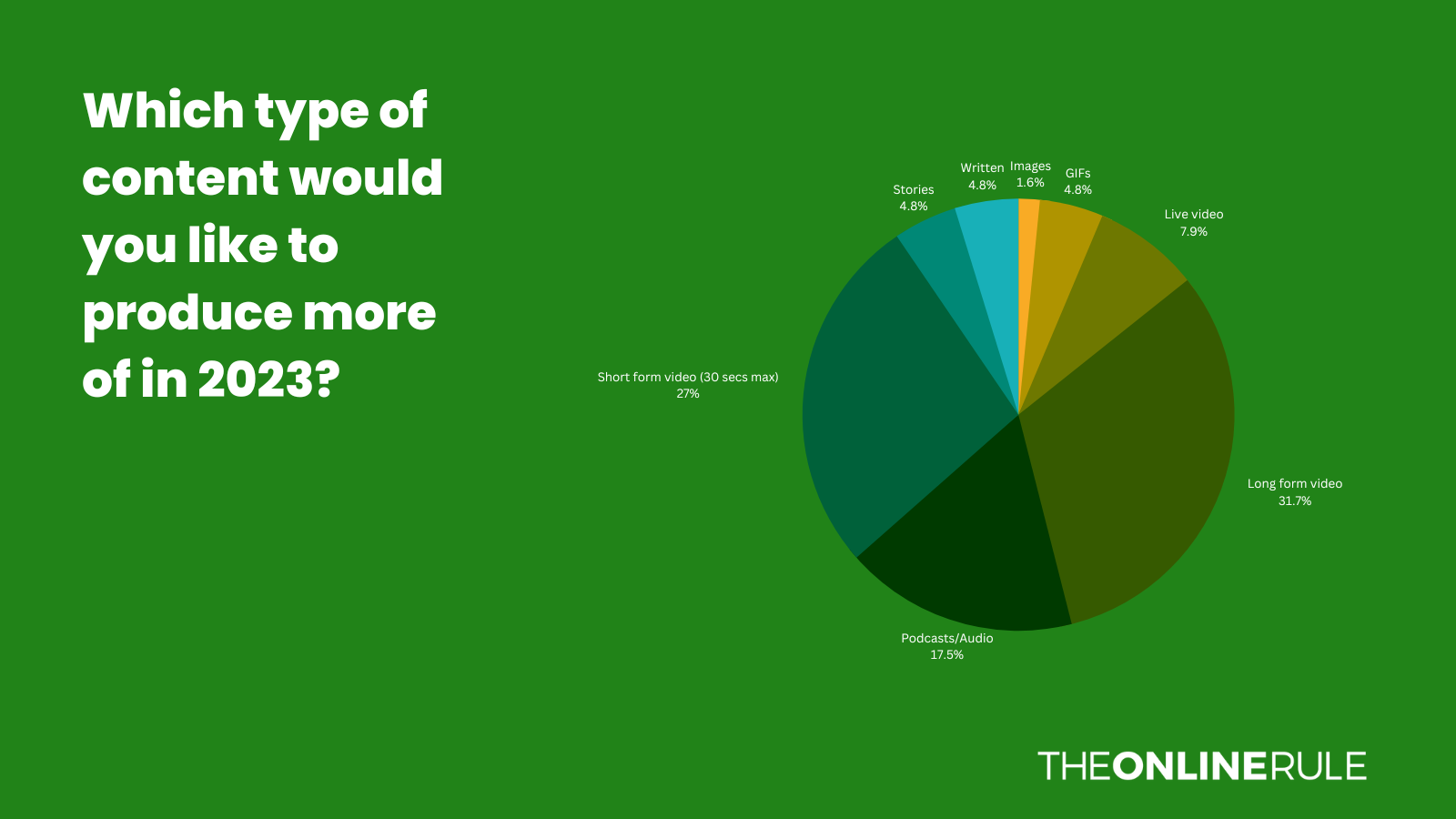

Last year, short-form video was most popular (31%) with long-form in second place (29%). This year, those figures have pretty much reversed. Podcasts are also up from 12% to 18%.

Strategies for success

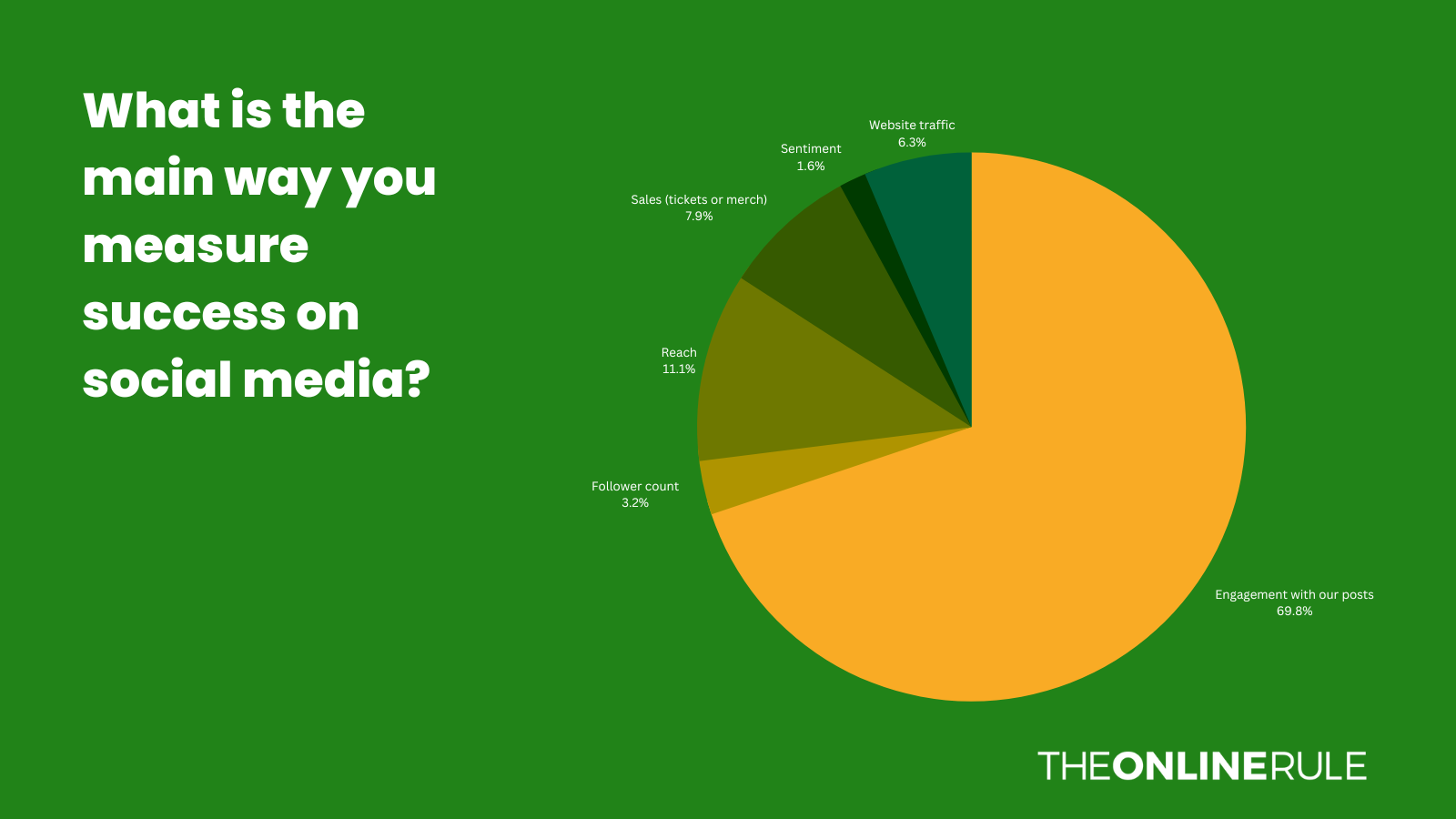

When it comes to how teams measure their success on social media, there's a clear winner: teams are looking for people to interact with their posts.

70% of respondents say that engagement is the main way they measure success, with 11% saying reach is the most important metric.

At elite level, this drops to 57% saying engagement is the main success criteria, with reach increasing to 17%. Among professional clubs these figures are 73% and 12%, and at non-league engagement is the main criteria for 92% of respondents (it's between that and sales of tickets or merch).

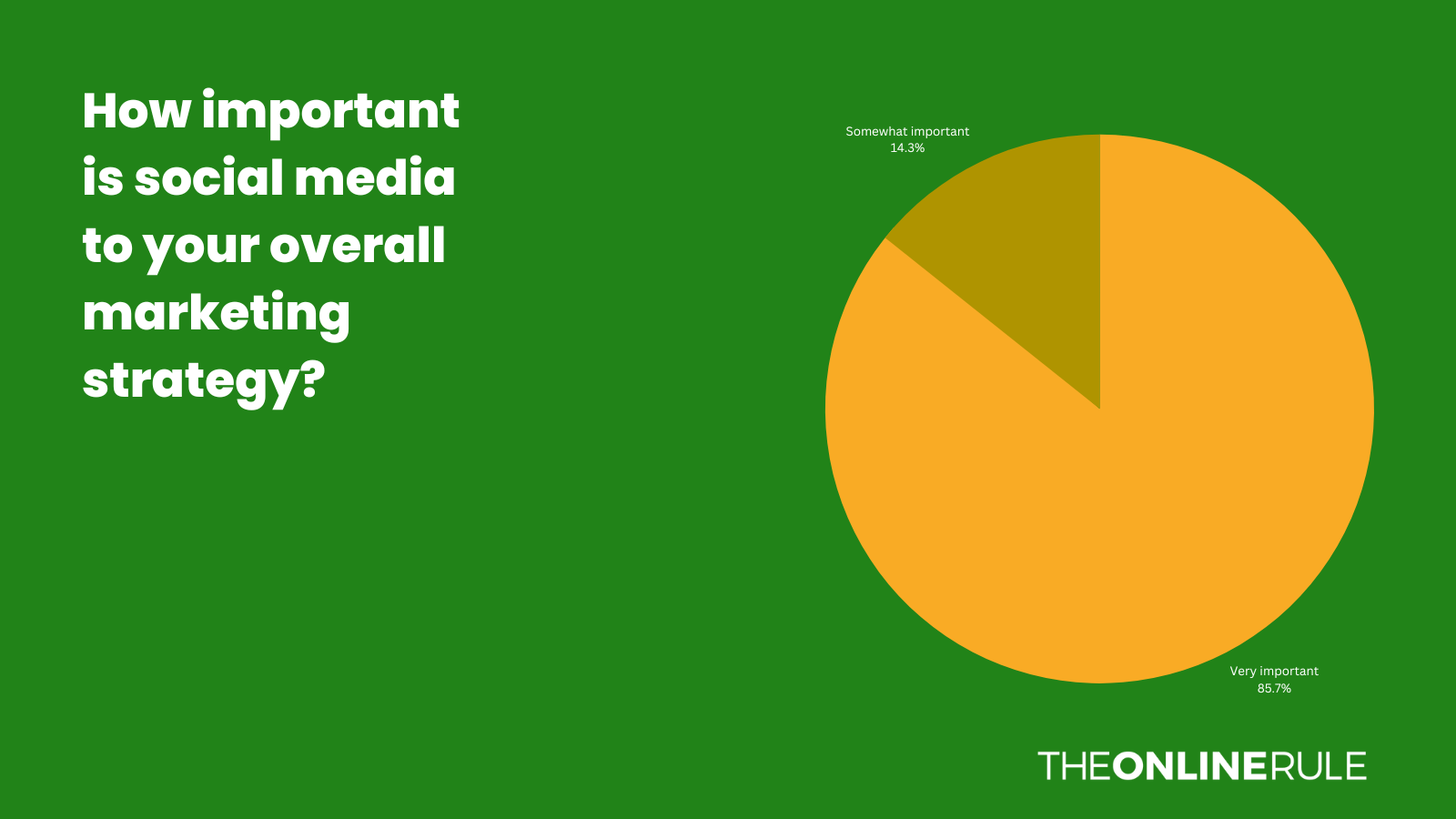

Social media remains important to teams' marketing, however. All respondents said it was either somewhat important or very important to their overall marketing strategies.

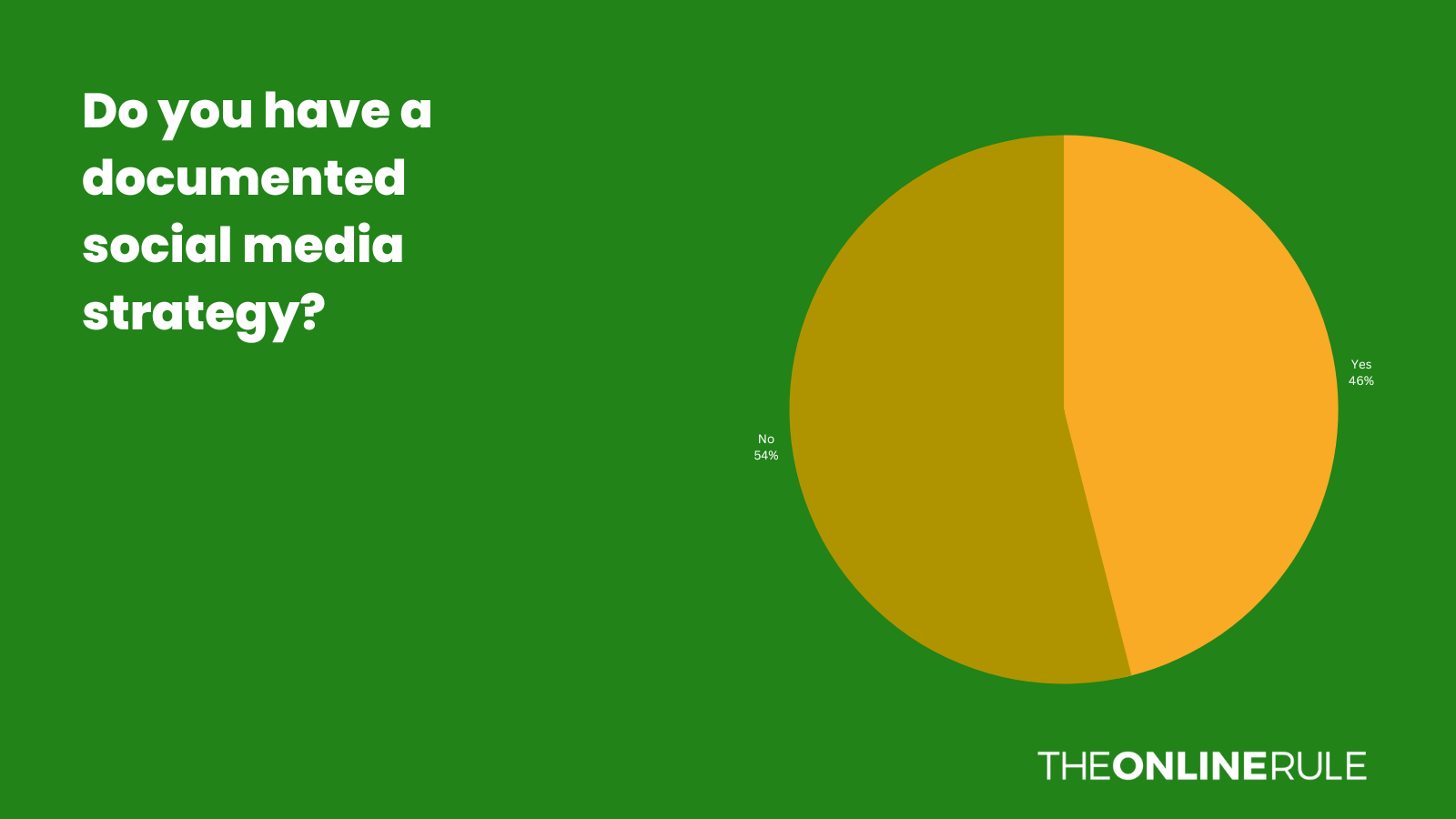

Despite this importance, less than half (46%) of teams have a documented social media strategy.

57% of teams at elite level have documented strategies, 50% at professional level, 25% at non-league level, and 0% among amateur teams.

While the drop down the levels might not be a huge surprise, it still seems surprising in this day and age that 44% of teams at the top level don't have a documented social strategy. Especially given its importance to marketing.

Team size plays a bit of a part here. Among marketing teams containing 16+ people, 100% of respondents have a strategy. This is 75% of teams with over six people, and drops to 37% for clubs with a marketing team of fewer than five.

Free reign

Another first: at the end of the survey I gave respondents the chance to contribute anything additional that wasn't covered that they had as their main marketing focus for 2023.

There were some great responses here. Some people said things such as increasing attendances ("butts on seats"), as well as bigger challenges such as "converting engagement into tangible income and results". Some other picks were:

- Promote team spirit

- To drive revenue from all social channels where possible

- Our star players and owners

- Community engagement

- Growing the women's game

- Have a more community 'one club' approach

- Targeting sectarian bias in Scottish football

- Inclusivity

- Grow the name of the club virtually

A lot of responses revolved around engagement and storytelling, which is refreshing to see. Clubs remain perfectly placed to tell stories and build communities, and I'd love to see that come more to the fore in 2023.

Interactive dashboard

For this year's results, I've produced an interactive dashboard you can have a play around with. It doesn't work too well on mobile - a limitation of Looker Studio (formerly Google Data Studio) - but it's been received well by a few people who I asked to give it a trial run. You can view the dashboard and have a play around with the data here.

Feel free to share this piece online, as well as anything you notice from the data. I'm on Twitter, LinkedIn, Facebook, and Instagram if you produce anything interesting and want to tag me in it. You can also email scott@theonlinerule.com if anything's not working as you think it should.